Canadian international merchandise trade, January 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-03-07

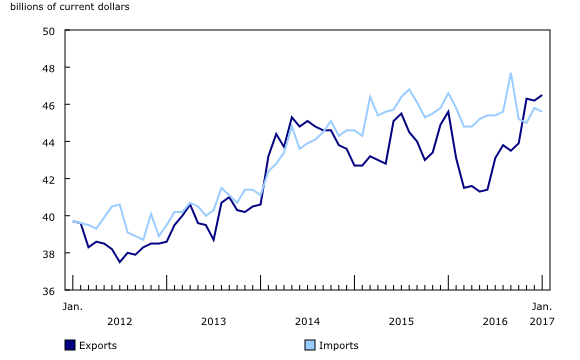

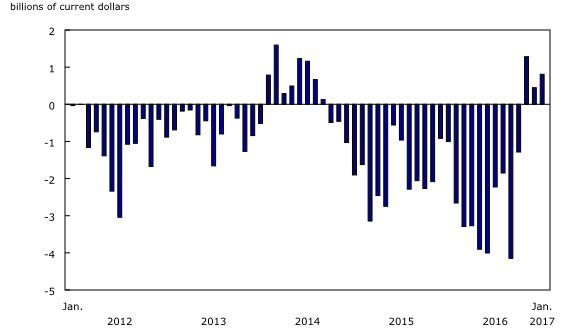

Canada's merchandise trade balance with the world posted a third consecutive monthly surplus, widening from $447 million in December to $807 million in January. Exports were up 0.5% on the strength of higher exports of motor vehicles and canola. Imports edged down 0.3% in January, mainly due to lower imports of unwrought gold.

Exports reach record high

Total exports increased 0.5% to a record $46.5 billion in January, despite declines in 6 of 11 sections. Volumes rose 1.0% while prices were down 0.5%. Higher exports of motor vehicles and parts, as well as farm, fishing and intermediate food products were the largest contributors to the increase.

These increases were partially offset by declines in exports of consumer goods, as well as metal and non-metallic mineral products. In January, exports excluding energy products rose 0.9%. Year over year, total exports increased 1.8%.

Following a 6.7% decrease in December, related to a higher proportion of motor vehicles destined for the domestic market, exports of motor vehicles and parts rose 7.7% to $7.8 billion in January. Exports of passenger cars and light trucks, up 12.3% to $5.4 billion, contributed the most to the January increase.

Exports of farm, fishing and intermediate food products also contributed to the overall increase in January, advancing 12.8% to a record high of $3.1 billion, on larger volumes. Canola exports rose 38.4% to a record high of $845 million and have more than doubled since October. These gains reflected higher Chinese demand for Canadian canola.

Metals lead the drop in imports

Total imports edged down 0.3% in January to $45.6 billion, with 7 of 11 sections posting declines. Prices decreased 2.7%, while volumes rose 2.5%. The decline in imports of metal and non-metallic mineral products, as well as industrial machinery, equipment and parts was partially offset by higher imports of motor vehicles and parts. Year over year, total imports were down 2.1%.

Following a 7.5% increase in December, imports of metal and non-metallic mineral products fell 5.5% to $3.8 billion in January, largely due to lower imports of unwrought gold. Overall, volumes were down 3.2% and prices decreased 2.4%.

Imports of motor vehicles and parts were up 3.6% in January to $8.9 billion, returning to October levels. Imports of passenger cars and light trucks, which rose 10.9% in January to reach $4.1 billion, were behind this gain, mainly attributable to higher imports from the United States and the United Kingdom. This was the largest percentage increase since September 2010.

Increased exports to the United States

Exports to the United States rose 2.3% to $34.6 billion in January, led by higher exports of passenger cars and light trucks. Imports from the United States edged up 0.3% to $30.1 billion. As a result, Canada's trade surplus with the United States widened from $3.8 billion in December to $4.5 billion in January. The Canadian dollar gained 0.8 cents US relative to the US dollar in January.

Exports to countries other than the United States fell 4.4% to $11.8 billion in January. Lower exports to Switzerland (-$298 million) and Spain (-$200 million)—both due to fewer aircraft exports—contributed to the decline.

Imports from countries other than the United States decreased 1.3% to $15.5 billion in January. Imports from Japan fell $273 million on lower imports of passenger cars and light trucks. As a result, Canada's trade deficit with countries other than the United States widened from $3.4 billion in December to $3.7 billion in January. Canada recorded a surplus with 4 of its 10 principal trading partners in January.

Higher real imports

In real (or volume) terms, imports rose 2.5%, largely on higher imports of motor vehicles and parts, energy products, and electronic and electrical equipment and parts. Export volumes were up 1.0% in January, on higher real exports of motor vehicles and parts. Consequently, Canada's trade surplus with the world in real terms narrowed from $1.7 billion in December to $1.2 billion in January.

Revisions to December imports and exports

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, and amendments made for late documentation of high-value transactions. Imports in December, originally reported as $45.5 billion in last month's release, were revised to $45.8 billion in the current month's release. Exports, originally reported as $46.4 billion in last month's release, were revised to $46.2 billion.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

The Canadian Pacific Railway

From 1881 to 1896, the Canadian Pacific Railway was built to connect Western Canada and Eastern Canada, and later expanded to link up with the American railway system.

During this period, Canadian exports grew 19.8%, primarily on increased shipments to Great Britain and the United States. Quebec and Ontario were the main exporting provinces, however, their share of total exports fell steadily as exports from British Columbia rose 369%, the largest increase for any Canadian province at the time.

Canadian imports rose 20.7% from 1881 to 1896, the majority coming from the British Empire and the United States. The share of imports from the United States increased from 40.1% in 1881 to 53.0% in 1896. On a customs basis, this share was 52.2% in 2016.

Canada's trade balance posted 13 consecutive deficits from 1882 to 1894, followed by a series of surpluses from 1895 to 1898.

Note to readers

Merchandise trade is one component of Canada's international balance of payments (BOP), which also includes trade in services, investment income, current transfers and capital and financial flows.

International trade data by commodity are available on both a BOP and a customs basis. International trade data by country are available on a customs basis for all countries and on a BOP basis for Canada's 27 principal trading partners (PTPs). The list of PTPs is based on their annual share of total merchandise trade—imports and exports—with Canada in 2012. BOP data are derived from customs data by making adjustments for factors such as valuation, coverage, timing and residency. These adjustments are made to conform to the concepts and definitions of the Canadian System of National Accounts.

For a conceptual analysis of BOP versus customs-based data, see "Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners."

For more information on these and other macroeconomic concepts, see the Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) and User Guide: Canadian System of Macroeconomic Accounts (13-606-G).

Data in this release are on a BOP basis, seasonally adjusted and in current dollars. Constant dollars are calculated using the Laspeyres volume formula (2007=100).

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions

In general, merchandise trade data are revised on an ongoing basis for each month of the current year. Current-year revisions are reflected in both the customs and BOP-based data.

The previous year's customs data are revised with the release of the January and February reference months and then on a quarterly basis. The previous two years of customs-based data are revised annually and revisions are released in February with the December reference month.

The previous year's BOP-based data are revised with the release of the January, February, March and April reference months. To remain consistent with the Canadian System of Macroeconomic Accounts, revisions to BOP based data for previous years are released annually in December with the October reference month.

Factors influencing revisions include the late receipt of import and export documentation, incorrect information on customs forms, replacement of estimates produced for the energy section with actual figures, changes in classification of merchandise based on more current information, and changes to seasonal adjustment factors.

For information on data revisions for crude oil and natural gas, see "Revisions to trade data for crude oil and natural gas."

Revised data are available in the appropriate CANSIM tables.

Changes to the Harmonized Commodity Description and Coding System

Changes were introduced to the Harmonized Commodity Description and Coding System (HS) starting in January 2017.

The changes are due in part to World Customs Organization updates to the six-digit HS codes, which are applied every five years to reflect changing international standards and trade patterns.

Additional changes have been applied at the HS ten-digit (import) and HS eight-digit (export) levels in order to improve the coding system. The changes are intended to address data gaps, eliminate seldom-used categories and reduce response burden for importers and exporters.

A concordance between the 2012 and the 2017 six-digit HS classification codes is now available. This concordance table lists the terminated HS codes alongside with the new 2017 recoded HS codes at the six-digit level.

More detailed concordances at the eight- and ten-digit Harmonized Commodity Description and Coding System classification code level are available upon request (statcan.itdtrade-dcicommerce.statcan@canada.ca).

Real-time CANSIM tables

Real-time CANSIM table 228-8059 will be updated on March 20. For more information, consult the document Real-time CANSIM tables.

Next release

Data on Canadian international merchandise trade for February will be released on April 4.

Products

Customs based data are now available in the Canadian International Merchandise Trade Database (65F0013X).

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Benoît Carrière (613-415-5305; benoit.carriere@canada.ca), International Accounts and Trade Division.

- Date modified: