National balance sheet and financial flow accounts, third quarter 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-12-14

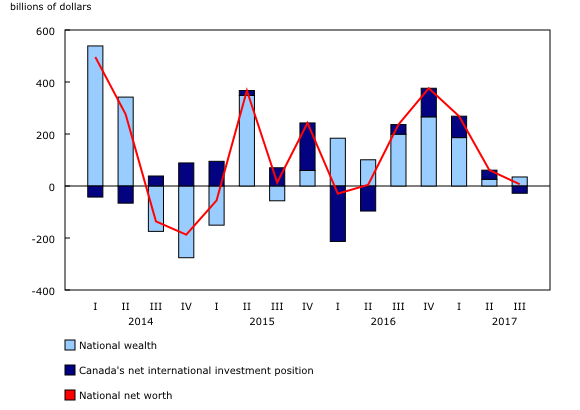

National wealth, the value of non-financial assets in the Canadian economy, rose 0.3% to $10,557.9 billion at the end of the third quarter, the second consecutive quarter of slow growth.

Canada's net foreign asset position fell by $27.9 billion to $298.3 billion in the third quarter, following four consecutive quarterly increases. The reduction mainly reflected the effect of an appreciating Canadian dollar, which lowered the value of foreign currency-denominated assets and liabilities by $79.8 billion when converted to Canadian dollars. In the third quarter, 96% of Canada's international assets were denominated in foreign currencies, compared with 37% for international liabilities.

National net worth, the sum of national wealth and Canada's net foreign asset position, increased by $6.9 billion to $10,856.2 billion, the smallest gain since the second quarter of 2016. On a per capita basis, national net worth was $294,500 at the end of the third quarter.

Household sector net worth is stable as credit market debt rises at a slower pace

Overall, net worth of the household sector was flat at $10,614.7 billion in the third quarter, edging down 0.1% from the previous quarter. The value of household residential real estate declined by $3.0 billion in the third quarter due to weakening housing resale prices. This was the first quarterly decline since the first quarter of 2009. The value of financial assets of households edged up 0.1%.

Total household credit market debt (consumer credit, and mortgage and non-mortgage loans) reached $2,110.3 billion in the third quarter, up 1.4% from the previous quarter. Mortgage debt was the main contributor, increasing 1.5% to $1,384.2 billion. Consumer credit was also up, rising 1.2% to $620.7 billion. On a year-over-year basis, consumer credit has increased 4.8% since the same quarter last year. The share of mortgage liabilities to total credit market debt edged up to 65.6%.

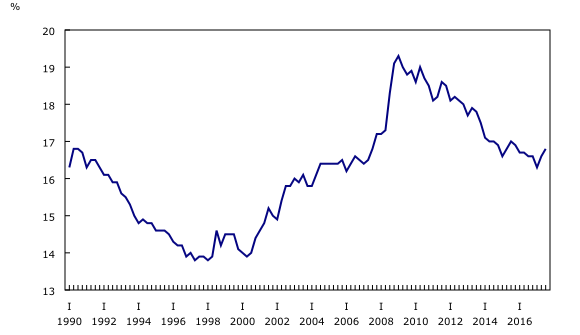

Household credit market debt as a proportion of household disposable income (adjusted to exclude pension entitlements) increased to 171.1% in the quarter from 170.1% in the second quarter (revised from 167.8%; see note to readers). In other words, there was $1.71 in credit market debt for every dollar of household disposable income. Leverage, measured by the ratio of household total debt to total assets, edged up from 16.6% to 16.8% by the end of the third quarter, as debt grew at a faster pace (+1.4%) than the value of total assets (+0.1%).

Households' debt service ratio declines

On a seasonally adjusted basis, households borrowed $23.4 billion of credit market debt in the third quarter, down from $28.7 billion in the second quarter. Mortgage borrowing decreased $0.8 billion to $16.2 billion. Similarly, borrowing in the form of consumer credit and non-mortgage loans decreased $4.6 billion to $7.1 billion.

The household debt service ratio, measured as total obligated payments of principal and interest as a proportion of household disposable income, was relatively flat at 13.9% in the third quarter. Similarly, the interest-only debt service ratio, defined as household mortgage and non-mortgage interest as a proportion of adjusted household disposable income, stood at 6.3%, down slightly from the previous quarter (6.4%).

Federal government net debt position improves

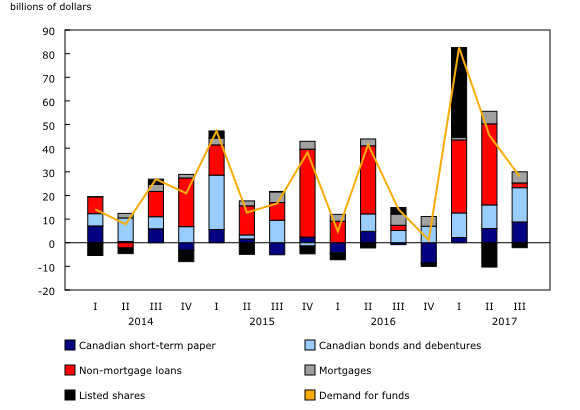

The federal government demand for funds slowed in the third quarter as they recorded a net issuance of $11.4 billion of Canadian bonds, largely sold to non-residents, which was more than offset by $16.6 billion in net retirements of short-term paper. Conversely, the demand for funds by all other levels of governments was $12.5 billion. The bulk of this borrowing was $9.1 billion in net issuances of bonds and debentures.

The ratio of federal government net debt (book value) to gross domestic product (GDP) edged down from 29.3% at the end of the second quarter to 29.2%. Similarly, the ratio of other government net debt (book value) to GDP edged down to 27.4% over that same period, as GDP grew at a faster pace than government net debt (book value).

Demand for funds by non-financial private corporations slows

Non-financial private corporations' demand for funds fell sharply, from $45.4 billion in the second quarter to $28.0 billion in the third quarter, the second consecutive quarterly decline. This was primarily due to non-mortgage loans, which decreased by $32.2 billion.

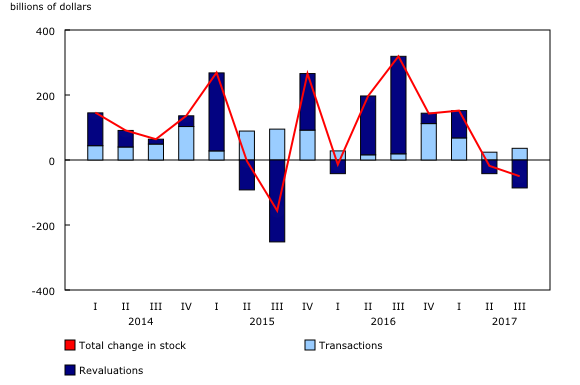

Non-financial private corporations' total financial assets increased by $48.2 billion in the third quarter to $3,420.9 billion, primarily as a result of upward revaluations of equity as asset prices rose. Meanwhile, financial liabilities of this sector increased by $86.6 billion, resulting in a $23.9 billion decrease in net worth.

Financial corporations' financial assets decline

The financial sector provided $11.2 billion of funds to the economy through financial market instruments, down from the previous quarter's elevated value of $67.8 billion. This reduction in lending was the result of declines in most instruments, including non-mortgage loans (-$41.4 billion), short-term paper (-$18.8 billion), consumer credit (-$6.3 billion), mortgages (-$2.3 billion) and bonds (-$11.1 billion), which together more than offset increases in listed shares (+$23.4 billion).

The decrease in the supply of funds was accompanied by downward revaluations, as the value of total financial assets of this sector was down by $36.8 billion at the end of the third quarter to $13,473.7 billion. This was the largest decrease since the second quarter of 2012. The other changes in assets account, which tracks changes in the value of assets and liabilities not caused by transactions, recorded a decline in value of $116.6 billion for financial assets held by the sector at the end of the third quarter. The main contributors to the downward revaluation were Canadian bonds and debentures (-$61.3 billion) and unlisted shares (-$62.3 billion), as a result of changes in asset prices.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

The Canada Savings Bonds program first began in 1946, growing out of the Victory Bonds program that helped finance the First and Second World Wars. With the success of the Victory Bonds program, the Canadian government decided to implement a similar post-war financing initiative as a source of funding and to encourage saving among Canadians.

Within the Canada Savings Bond program, different options were available such as the Canada Savings Bond, Canada Premium Bond, Canada Retirement Saving Plan, and Canada Retirement Income Fund. Participation was restricted solely to Canadian households. The interest rate of these bonds has varied over the years, reaching a high of 19.5% in 1981 compared with the first issue rate of 2.75% in 1946.

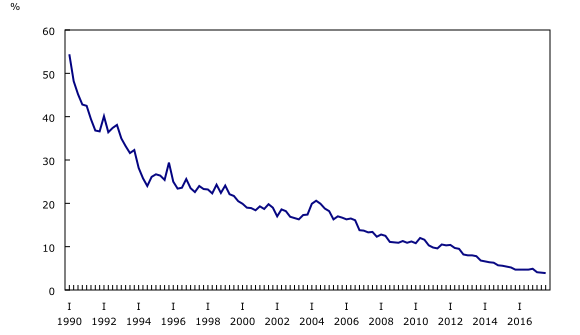

The program peaked in 1987 with approximately $55 billion worth of Canada Savings Bonds held by Canadian households. Starting in the early 1990s, however, the program experienced a decline in demand, likely due to factors such as lower returns relative to other investment opportunities and more advantageous investment vehicles becoming available such as mutual funds, exchange traded funds, and guaranteed investment certificates.

In the first quarter of 1990, Canada Savings Bonds accounted for over half (54.4%) of total bonds held by households and approximately 23% of all bonds issued by the Federal government. However, by the third quarter of 2017, they accounted for less than 4% of total bonds held by households and less than 1% of bonds issued by the Federal government.

On November 1, 2017, the Government of Canada discontinued the issuance of Canada Savings Bonds. Although historically the Canada Savings Bonds program was a cost effective source of government financing and a trusted mechanism for Canadians to save, rising administrative costs required to maintain the program, coupled with the introduction of new investment products and changing economic circumstances, led to a decline in the popularity of the program.

Note to readers

This release of the financial and wealth accounts is comprised of the national balance sheet accounts (NBSA), financial flow accounts (FFA), and other changes in assets accounts (OCAA).

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA cover all national non-financial assets and financial asset-liability claims outstanding in all sectors. To improve the interpretability of the estimates of the financial flows, selected household borrowing series are available on a seasonally adjusted basis (CANSIM table 378-0127). All other data are unadjusted for seasonal variation. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The FFA articulate net lending or borrowing activity by sector by measuring financial transactions in the economy. The FFA arrive at a measure of net financial investment, which is the difference between transactions in financial assets and liabilities (for example, net purchases of securities less net issuances of securities). The FFA also provide the link between financial and non-financial activity in the economy, which ties estimates of saving and non-financial capital acquisition (for example, investment in new housing) with the underlying financial transactions.

While the financial flow accounts record changes in financial assets and liabilities between opening and closing balance sheets that are associated with transactions during the accounting period, the value of assets and liabilities held by an institutional unit can also change for other reasons. These other types of changes, referred to as other economic flows, are recorded in the other changes in assets account.

There are two main components to this account. One is the other changes in the volume of assets account. This account includes changes in non-financial and financial assets and liabilities relating to the economic appearance and disappearance of assets, the effects of external events such as wars or catastrophes on the value of assets and changes in the classification and structure of assets. The other main component is the revaluation account, showing holding gains or losses accruing to the owners of non-financial and financial assets and liabilities during the accounting period as a result of changes in market price valuations.

At present, only the aggregate other change in assets is available within the Canadian System of Macroeconomic Accounts; no details are available on the different components.

Definitions concerning financial indicators can be found in Financial indicators from the National Balance Sheet Accounts in the System of macroeconomic accounts glossary.

Revisions

This third quarter release of the national balance sheet and financial flow accounts includes revised data from the first quarter of 1990 to the second quarter of 2017. These data incorporate new and revised data, as well as updated data on seasonal trends.

The overall trend in the credit market debt to household disposable income adjusted for pension entitlements has remained unchanged throughout the whole period. However, a significant downward revision to household disposable income in 2016, due to the incorporation of information received from the latest T4 tax filings, resulted in an upwards shift to this ratio.

In the near future, data enhancements to the national balance sheet and financial flow accounts will be incorporated such as the development of detailed counterparty information by sector. In order to facilitate this initiative and others it will be necessary to extend the annual revision period (normally the previous three years) at the time of the third quarter release. As such, for the next three years, with the third quarter release, the data will be revised back to 1990 to ensure a continuous time series.

Additional information on the treatment of natural resource wealth in the National Balance Sheet Accounts is available in the article "Natural resource wealth statistics in the National Balance Sheet Accounts."

Next release

Data on the national balance sheet and financial flow accounts for the fourth quarter of 2017 will be released on March 15, 2018.

Products

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The System of Macroeconomic Accounts module features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: