Industrial product and raw materials price indexes, January 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-02-26

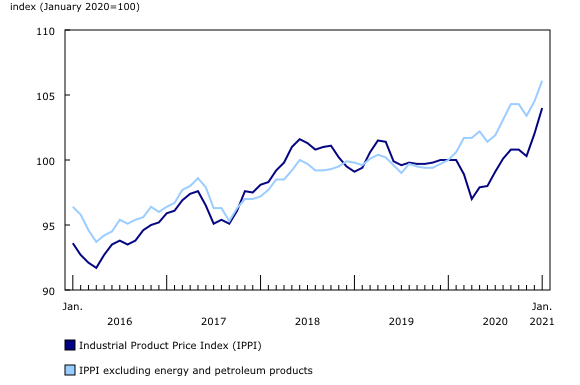

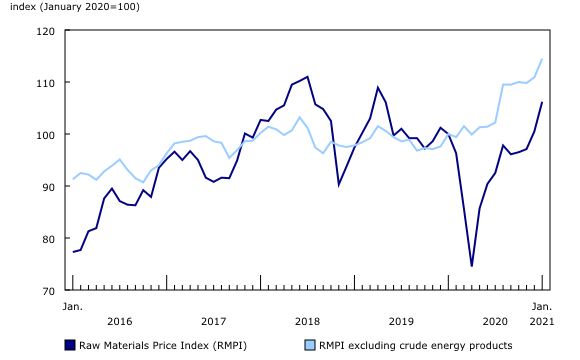

Prices for products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), rose 2.0% in January, mainly as a result of higher prices for lumber and other wood products, as well as energy and petroleum products. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), were up 5.7%, driven mainly by higher prices for crude energy products.

Industrial Product Price Index

In January, the IPPI rose 2.0%, its strongest monthly increase since February 2015 (+2.0%). Of the 21 major product groups, 15 were up, 5 were down and 1 was unchanged.

Prices for lumber and other wood products (+10.8%) were the biggest contributor to the IPPI's growth. Prices for softwood lumber increased 19.0% in January, following a strong gain of 20.5% in December. Compared with January 2020, softwood lumber prices surged 112.1%. Persistent demand for softwood lumber was a contributing factor in these increases. From December to January, the annualized number of housing starts in Canada rose 23.1% to 282,428 units.

Energy and petroleum product prices (+7.9%)—posting its fourth consecutive monthly increase—also contributed greatly to the January growth in the IPPI, primarily as a result of higher prices for refined petroleum products (+8.2%). While prices for all refined petroleum products rose compared with December, motor gasoline (+10.4%) and diesel and biodiesel fuels (+4.6%) led the increase in this category.

Prices for chemicals and chemical products increased 3.3%, primarily as a result of higher prices for petrochemicals (+10.2%), ammonia and chemical fertilizers (+14.5%), and plastic resins (+5.8%).

Prices for primary non-ferrous metal products (+1.5%) and meat, fish and dairy products (+1.8%) also rose in January.

The increase in prices for primary non-ferrous metal products was mostly driven by a 1.7% rise in prices for unwrought gold, silver and platinum group metals, and their alloys. According to the London Bullion Market Association, the average value of silver increased 3.4% in January to CAD $33.00 per ounce, while the value of gold remained relatively stable.

Higher prices for fresh and frozen beef and veal (+5.5%) and—to a lesser extent—fresh and frozen poultry of all types (+2.7%), and fresh and frozen pork (+2.1%) were primarily responsible for the gain observed in meat, fish and dairy products.

Year over year, the IPPI increased 4.0%. Higher prices for lumber and other wood products (+61.6%) and primary non-ferrous metal products (+23.4%) were the principal causes of this gain.

Raw Materials Price Index

The RMPI increased 5.7% in January, following growth of 3.5% in December. This was the fourth straight monthly increase and the strongest gain since August 2020 (+5.7%). All six major product groups were up in January.

Crude energy product prices rose 11.4%, pulled upward mainly by higher prices for conventional crude oil (+11.5%), synthetic crude oil (+13.8%), and natural gas (+6.0%). However, compared with January 2020, crude energy prices fell 8.2%. Ongoing supply restrictions imposed by the Organization of the Petroleum Exporting Countries and its partner countries, along with an anticipated increase in oil demand, continued to exert upward pressure on crude oil prices in January.

Crop products were up 9.1% in January, driven in large part by higher prices for canola (+15.9%), which have been trending upward since March 2020. This was also the largest monthly increase for canola since February 2008 (+16.1%). Among other crop products, prices for grains (except wheat) rose 7.0% and oilseed (except canola) prices increased 17.1%.

Prices for metal ores, concentrates and scrap (+2.1%) and animals and animal products (+1.8%) also rose compared with December.

Year over year, the RMPI was up 6.2%—its first increase since January 2020. This growth was led by higher prices for metal ores, concentrates and scrap (+25.8%).

Note to readers

The Industrial Product Price Index (IPPI) and the Raw Materials Price Index (RMPI) are available at the Canada level only. Selected commodity groups within the IPPI are also available by region.

With each release, data for the previous six months may have been revised. The indexes are not seasonally adjusted.

The Industrial Product Price Index reflects the prices that producers in Canada receive as goods leave the plant gate. The IPPI does not reflect what the consumer pays. Unlike the Consumer Price Index, the IPPI excludes indirect taxes and all costs that occur between the time a good leaves the plant and the time the final user takes possession of the good. This includes transportation, wholesale and retail costs.

Canadian producers export many goods. They often indicate their prices in foreign currencies, especially in US dollars, and these prices are then converted into Canadian dollars. In particular, this is the case for motor vehicles, pulp and paper products, and wood products. Therefore, fluctuations in the value of the Canadian dollar against its US counterpart affect the IPPI. However, the conversion to Canadian dollars reflects only how respondents provide their prices. This is not a measure that takes into account the full effect of exchange rates.

The conversion of prices received in US dollars is based on the average monthly exchange rate established by the Bank of Canada and available in Table 33-10-0163-01 (series v111666275). Monthly and annual variations in the exchange rate, as described in the release, are calculated according to the indirect quotation of the exchange rate (for example, CAN$1 = US$X).

The Raw Materials Price Index reflects the prices paid by Canadian manufacturers for key raw materials. Many of those prices are set on the world market. However, as few prices are denominated in foreign currencies, their conversion into Canadian dollars has only a minor effect on the calculation of the RMPI.

Basket update and methodology changes

Starting with the October 2020 reference period, the IPPI and RMPI are using an updated basket and methodology. The indexes have been converted from 2010 = 100 to January 2020 = 100 and also updated to use a weighting pattern based on the 2016 production values of Canadian manufacturers.

At the same time, the IPPI and RMPI have been modernized with the adoption of a weighted geometric (Jevons) formula and incorporation of parental imputation as the default imputation methodology for missing price quotes.

The IPPI and RMPI are now using the North American Product Classification System (NAPCS) Canada 2017 version 2.0 and the North American Industry Classification System (NAICS) Canada 2017 version 3.0.

Products

Statistics Canada launched the Producer price indexes portal as part of a suite of portals for prices and price indexes. This web page provides Canadians with a single point of access to a variety of statistics and measures related to producer prices.

The video "Producer Price Indexes" is available on the Statistics Canada Training Institute web page. It provides an introduction to Statistics Canada's producer price indexes—what they are, how they are made and what they are used for.

Next release

The industrial product and raw materials price indexes for February will be released on March 31.

Contact information

For more information, or to enquire about the concepts, methods, or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: