Gross domestic product, income and expenditure, fourth quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-03-02

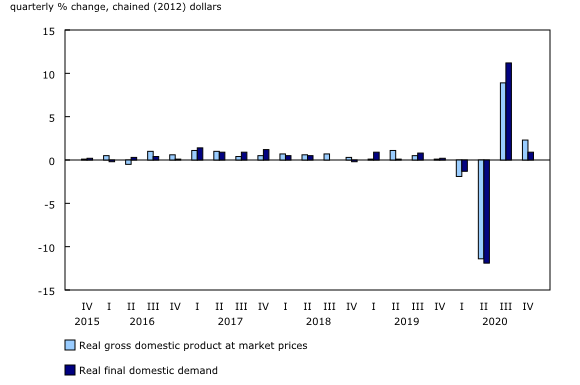

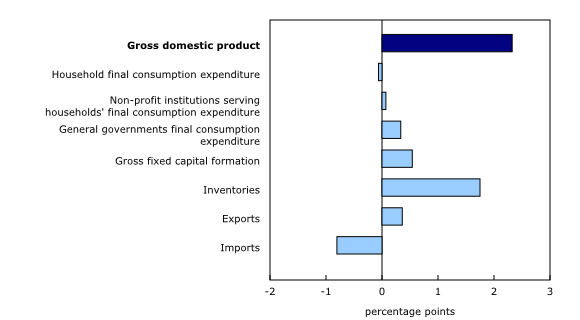

Real gross domestic product (GDP) grew 2.3% in the fourth quarter of 2020, following record fluctuations in the previous two quarters. In 2020, real GDP shrank 5.4%, the steepest annual decline since quarterly data were first recorded in 1961. Final domestic demand rose 0.9% in the fourth quarter, but was down 4.5% for 2020 overall.

Growth in real GDP was strengthened by a large change in business inventories, as well as increases in government final consumption expenditure, business investment in machinery and equipment, and housing investment. Housing investment increases coincided with low mortgage rates and rising demand for housing.

The large inventory drawdowns that were a drag on third-quarter GDP growth were absent in the fourth quarter as inventories recorded a small accumulation. For non-farm business inventories, the sizeable shift was concentrated in the retail sector, with accumulation observed for motor vehicle, building supply and sporting goods retailers. Accumulation of cannabis stocks largely contributed to the increase in farm inventories. The economy-wide stock-to-sales ratio fell from 0.843 in the third quarter to 0.836 in the fourth quarter.

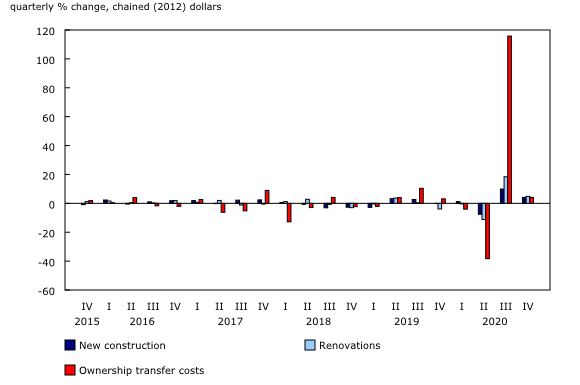

Housing investment continues to rise

Housing investment increased 4.3% in the fourth quarter, after rising 30.7% in the third quarter.

The increases were broad-based: new construction grew 4.1%, renovations rose 4.8% and ownership transfer costs were up 4.1%. A substantial increase occurred in new construction of both single-family and multiple-unit dwellings, especially in Ontario and Alberta. The increase in ownership transfer costs was widespread, as home resale activity continued to rise across the country. Compared with 2019, housing investment was up 3.9% in 2020, while household residential mortgage debt expanded significantly over the same period.

Business investment slackens

Business investment in engineering structures rose 1.6% in the fourth quarter, but investment in non-residential buildings fell 10.9%. This reflected weak demand for office buildings and shopping malls as remote working and online shopping became more common. Increased investment in machinery and equipment (+7.0%) coincided with higher imports of industrial machinery and equipment. Nevertheless, investment in machinery and equipment was down 16.4% in 2020.

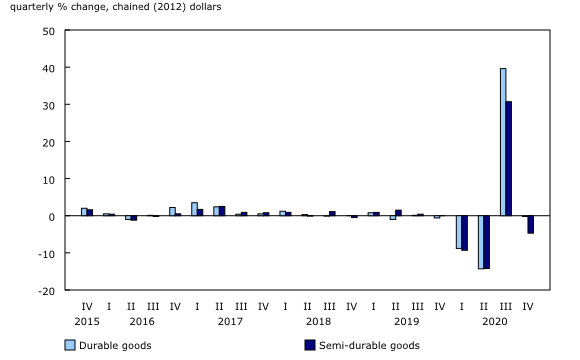

Household spending edges down

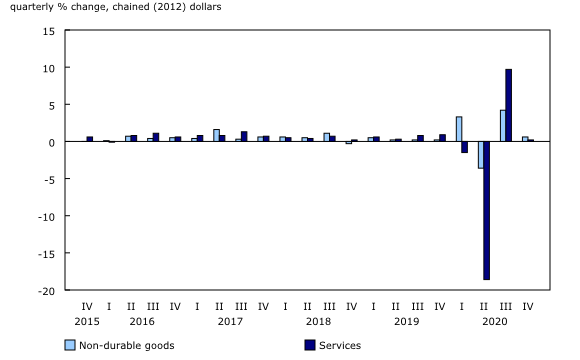

Household spending edged down 0.1% in the fourth quarter, after a 13.1% increase in the third quarter. Spending was down 6.1% in 2020, compared with 2019.

Outlays for durable goods declined 0.2%, after the record increase (+39.6%) in the third quarter, which followed drops in the second quarter related to the COVID-19 pandemic. Decreases in purchases of new trucks, vans and sport utility vehicles (-3.5%), and new passenger cars (-6.4%) were partly offset by increased sales of used motor vehicles (+4.0%). This reflected consumers' tendency to opt for used goods at times of economic uncertainty.

Excluding these purchases, outlays for durable goods rose 1.6% in the fourth quarter. Household spending on major appliances (+9.0%) and furniture (+2.4%) rose, coinciding with stronger housing investment. Overall, spending on durable goods was down 3.7% in 2020.

Outlays for semi-durable goods fell 4.7% in the fourth quarter, after sharp fluctuations in the previous two quarters. Decline in clothing and footwear (-8.9%) was partly offset by increases in games, toys and hobbies (+0.7%), and equipment for sport, camping and open-air recreation (+6.9%). These movements reflected shifts in spending patterns in the wake of the pandemic. Spending on semi-durable goods was down 7.8% in 2020.

Outlays for non-durable goods rose 0.6%, after rising 4.2% in the third quarter. As consumers spent more time at home and less time travelling, expenditures on food (+3.1%), licensed cannabis (+17.0%) and pharmaceutical products (+7.1%) rose. Expenditures on fuels and lubricants (-5.4%) dropped, owing to reduced use because of new restrictions in British Columbia, Ontario and Quebec in the fourth quarter. Overall, spending on non-durable goods was up 3.1% in 2020 compared with 2019.

Growth in outlays on services slowed from 9.7% in the third quarter to 0.2% in the fourth. Increases in outpatient services (+6.7%), and insurance and financial services (+1.8%) were more than offset by lower spending on food, beverage and accommodation services (-11.1%), and personal grooming services (-7.5%), owing to closures and limited openings of bars, restaurants and salons. Overall, outlays for services were down 10.3% in 2020.

Export and import volumes slow

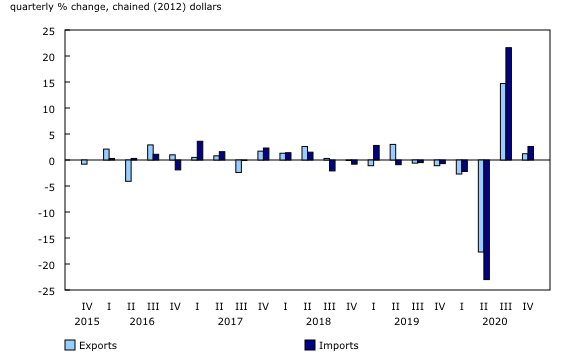

Growth in export volumes slowed from 14.7% in the third quarter to 1.2% in the fourth, reflecting reduced international demand, owing to slowdowns in the economies of major trading partners in the fourth quarter, notably the United States (+1.0%), the United Kingdom (+1.0%), the Netherlands (-0.1%), Germany (+0.1%) and Italy (-2.0%).

Exports of energy products (+6.1%) and metal and non-metallic mineral products (+10.8%) increased. Growth in the latter stemmed mainly from unwrought gold, silver, and platinum group metals, and their alloys; this surge reflected exports of refined gold to the United Kingdom, related to the Brexit-induced period of economic uncertainty. Export volumes were down 9.8% in 2020, compared with the volumes in 2019.

Import volumes rose 2.6% in the fourth quarter, following record fluctuations in the previous two quarters. Increases in imports of consumer goods (+5.5%), motor vehicles and parts (+5.3%), and industrial machinery and equipment (+8.3%) were partly offset by a decline in imports of metal and non-metallic mineral products (-10.7%). Overall, import volumes in 2020 were down 11.3%, compared with the volumes in 2019.

Terms of trade improve

The ratio of the price of exports to the price of imports—the terms of trade—rose 1.7%, primarily because of a 2.4% increase in prices of exported crude oil and crude bitumen in the fourth quarter. However, for 2020 overall, terms of trade declined by 3.4%, owing largely to a 38.6% drop in prices of exported crude oil and crude bitumen.

Nominal gross domestic product rises

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 1.1% in the fourth quarter. Consequently, growth in nominal GDP (+3.4%) was higher than that of real GDP. Compared with 2019, nominal GDP was down 4.6% in 2020.

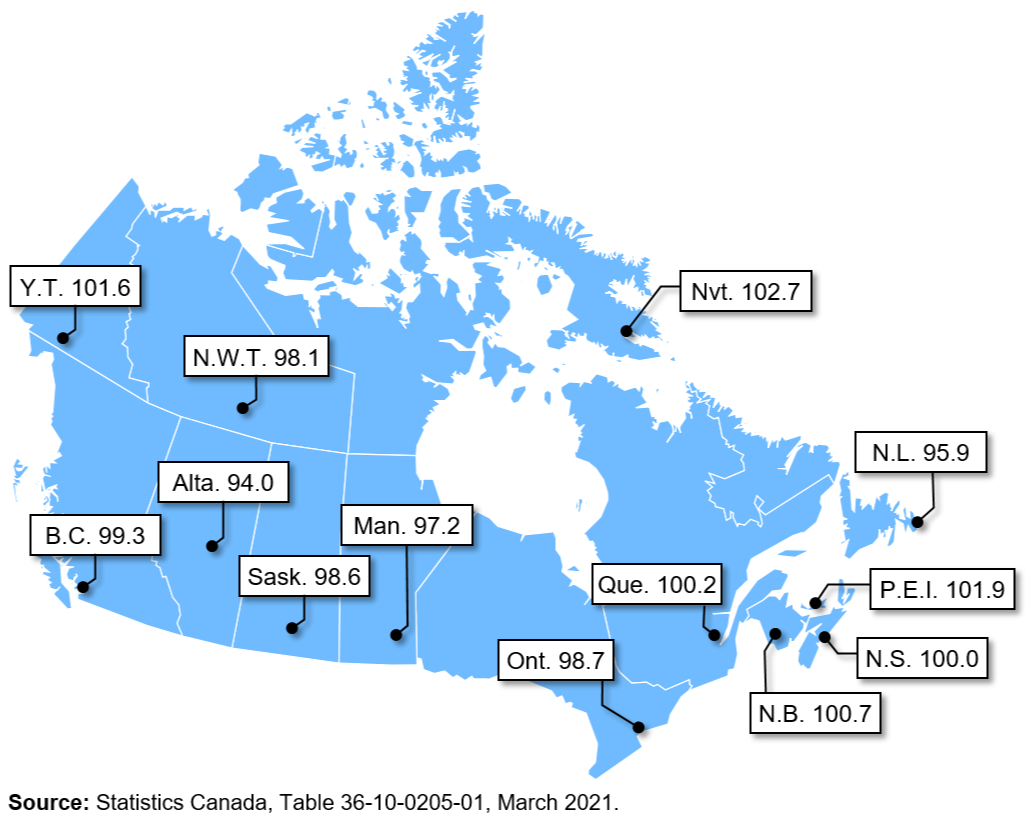

Compensation of employees rose 2.5% in the fourth quarter, following a 7.7% increase in the third. Despite this growth in the second half of 2020, compensation was 1.6% lower over the year compared with 2019. The Canada Emergency Wage Subsidy represented 3.3% of total compensation of employees in the fourth quarter, down from 7.3% in the third. Declines varied by region and were particularly sharp in the two oil-rich provinces, Alberta and Newfoundland and Labrador, reflecting the impact of lower prices of crude oil and crude bitumen in 2020.

Households end the year with third consecutive double-digit savings rate

Household disposable income dropped 1.0% in the fourth quarter, mainly because of a 17.2% decline in other benefits received from governments, such as the Canada Emergency Response Benefit. Despite this decline, disposable income was up 10.0% compared with 2019, the largest increase on record in nearly four decades, as governments took extraordinary economic support measures during the year. By the fourth quarter, the extent of this support had diminished considerably; nonetheless, government transfers still exceeded their pre-pandemic levels from the fourth quarter of 2019 by a sizeable margin (+33.2%).

The continued rebound in compensation, albeit at a reduced pace, coupled with still-elevated government transfers and stagnant consumption, kept the savings rate in double-digit territory for the third consecutive quarter. Canadians recorded a similar amount of savings in 2020 as in the previous seven years combined. Some of this savings made its way into currency and deposits of Canadian households, with growth in this asset nearing $160.0 billion over the first three quarters of the year. The savings rate for the fourth quarter stood at 12.7%, while the savings rate for 2020 was 15.1%. Transfers from governments exceeded losses in wages and self-employment income, resulting in lower-income and younger households recording some of the largest increases in savings.

Support program expenditures continue to fuel government borrowing

Overall, government revenues were far outstripped by expenditures throughout 2020, with the fourth quarter showing a marked increase from the second-quarter peak in governments' net borrowing of $443.8 billion.

Government revenue remained fairly flat over 2020, the notable exception being the second quarter, when a decline in tax revenue on both income and products reduced government coffers. By the fourth quarter, these components had regained lost ground, but annual government revenue was 3.9% lower than the preceding year.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Data on gross domestic product, income and expenditure are an example of how Statistics Canada supports the reporting on the global sustainable development goals. This release will be used to measure the following goals:

Note to readers

Revisions

Gross domestic product (GDP) data for the fourth quarter have been released along with revised data from the first to third quarter of 2020. These releases incorporate new and revised data, as well as updates on seasonal trends. Given the unprecedented economic situation in 2020, revisions for this period are expected to be higher than normal.

Support measures by governments

To alleviate the economic impact of the COVID-19 pandemic, governments implemented a number of programs, including the Canada Emergency Wage Subsidy and the Canada Emergency Response Benefit. For a comprehensive explanation of how government support measures were treated in the compilation of the estimates, see "Recording COVID-19 measures in the national accounts" and "Recording new COVID measures in the national accounts."

Details of some of the more significant government measures can be found in the footnotes of tables 36-10-0103-01, 36-10-0112-01, 36-10-0115-01, 36-10-0118-01, and 36-10-0477-01.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Percentage change

Percentage changes for expenditure-based statistics (such as household spending, investment, and exports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics (such as compensation of employees and operating surplus) are calculated from nominal values; that is, they are not adjusted for price variations.

Unless otherwise stated, growth rates represent the percentage change in the series from one quarter to the next; for instance, from the third quarter of 2020 to the fourth quarter of 2020.

Real-time tables

Real-time tables 36-10-0430-01 and 36-10-0431-01 will be updated on March 8.

Next release

Data on GDP by income and expenditure for the first quarter of 2021 will be released on June 1, 2021.

Products

The document, "Recording new COVID measures in the national accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The data visualization product "Infrastructure Statistics Hub," which is part of Statistics Canada – Data Visualization Products (71-607-X), is now available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: