Payroll employment, earnings and hours, and job vacancies, December 2022

Released: 2023-02-23

$1,173.90

December 2022

3.4%

(12-month change)

$1,176.83

December 2022

6.7%

(12-month change)

$985.86

December 2022

3.6%

(12-month change)

$1,033.77

December 2022

3.6%

(12-month change)

$1,077.70

December 2022

4.6%

(12-month change)

$1,129.54

December 2022

4.5%

(12-month change)

$1,197.94

December 2022

3.0%

(12-month change)

$1,073.01

December 2022

3.9%

(12-month change)

$1,147.21

December 2022

2.3%

(12-month change)

$1,268.07

December 2022

2.2%

(12-month change)

$1,153.32

December 2022

1.6%

(12-month change)

$1,342.74

December 2022

1.3%

(12-month change)

$1,574.24

December 2022

-0.4%

(12-month change)

$1,588.20

December 2022

5.8%

(12-month change)

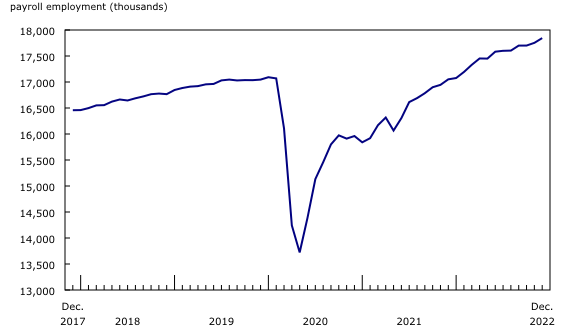

The number of employees receiving pay or benefits from their employer—measured as "payroll employees" in the Survey of Employment, Payrolls and Hours—rose by 91,400 (+0.5%) in December, bringing cumulative gains since September to 240,600 (+1.4%). Gains in December were largest in Ontario (36,900; +0.5%), Quebec (+18,900; +0.5%), Alberta (+12,700; +0.6%) and British Columbia (11,500; +0.5%).

Payroll employment increases in both the goods-producing and services-producing sectors

Payroll employment in the services-producing sector increased by 72,400 (+0.5%) in December. Gains were recorded in 8 of the 15 sectors, led by healthcare and social assistance (+26,500; +1.2%) and finance and insurance (+13,800; +1.7%), which together accounted for more than half of the increase in the services-producing sector. Employment in wholesale trade (-3,600; -0.4%) and information and cultural industries (-1,600; -0.4%) declined in December, while the remaining five sectors showed little change.

Meanwhile, payroll employment in the goods-producing sector increased by 13,600 (+0.4%) in December, with construction (+11,500; +1.0%) accounting for most of the increase.

Payroll employment in health care and social assistance continues to increase in December

Payroll employment grew by 26,500 (+1.2%) in health care and social assistance in December, marking the fourth consecutive monthly increase. Since January 2021, payroll employment in health care and social assistance has seen a total increase of 190,600 (+9.2%).

December 2022 gains in payroll employment in this sector were recorded in seven provinces, led by Quebec (+8,800; +1.7%), Ontario (+5,600; +0.7%), British Columbia (+4,600; +1.5%) and Alberta (+3,800; +1.6%). Newfoundland and Labrador (-100; -0.3%) recorded a slight decline, while there was little variation in Manitoba and Saskatchewan.

Nationally, increases in payroll employment in December were recorded in 15 of the 18 industries in the sector. The largest increase was recorded in general medical and surgical hospitals (+6,900; +1.2%), followed by outpatient care centres (+3,700; +2.3%) and individual and family services (+3,100; +1.7%). These three industries accounted for more than 40% of total payroll employment in the sector.

December gains in payroll employment in finance and insurance complete a year of continued growth in the sector

Payroll employment in finance and insurance increased by 13,800 (+1.7%) in December, capping off 2022 with continued month-over-month growth in the sector. Year over year, payroll employment in the sector grew by 59,000 (+7.6%) in December. Month-over-month gains in December were concentrated in Ontario (+6,700; +1.7%) and Quebec (+4,800; +2.8%).

Nationally, payroll employment in December increased in 7 out of 11 industries in the sector, led by insurance carriers (+4,100; +2.6%), agencies, brokerages and other insurance related activities (+2,400; +2.5%), and securities and commodity contracts intermediation and brokerage (+2,100; 4.0%).

Payroll employment in construction increases for the fourth consecutive month in December

In December, payroll employment in construction (+11,500; +1.0%) increased for the fourth consecutive month, bringing the total gains since September to 40,600 (+3.6%). In December, Ontario (+4,800, +1.2%) and Alberta (+2,500; +1.4%) recorded the largest monthly gains in construction.

Nationally, monthly gains in the sector were driven by highway, street and bridge construction (+2,700; +4.9%), foundation, structure, and building contractors (+2,600; +1.9%) and building equipment contractors (+2,100; +0.7%). Residential building construction (-2,400; -1.4%) was the only industry to record a month-over-month decline in December, coinciding with a 2.1% decline in residential building investments in the same month.

Year-over-year growth in average weekly earnings increased at a slower pace in December

On a year-over-year basis, average weekly earnings grew 3.4% to $1,174 in December, down from a year-over-year growth of 4.0% recorded in November. Newfoundland and Labrador (+6.7%, to $1,177) recorded the largest proportional gain in average weekly earnings in December, followed by New Brunswick (+4.6%, to $1,078) and Quebec (+4.5% to $1,130). Meanwhile, Alberta (+2.2%, to $1,268) and British Columbia (+1.6%, to $1,153) tempered the overall year-over-year growth. Growth in average weekly earnings can reflect a range of factors, including changes in wages, composition of employment and hours worked.

Year over year, average weekly earnings in the goods-producing sector increased by 3.7% in December. Gains in utilities (+8.5% to $2,070) and mining, quarrying and oil and gas extraction (+6.6% to $2,333) were dampened by slower growth in construction (+3.3% to $1,452) and manufacturing (+1.6% to $1,254).

Slightly slower year-over-year growth was observed in the services-producing sector (+3.0%). Stronger gains in real estate and rental and leasing (+8.2% to $1,293), information and cultural industries (+6.9% to $1,642) and wholesale trade (+6.7% to $1,407) partially compensated for slower growth in educational services (+2.6% to $1,174).

Average weekly hours continue to decline on a year-over-year basis

In December, year-over-year employment growth (+4.5%) outpaced growth in total hours worked (+2.7%), resulting in a decline in average weekly hours (-1.5% to 33.1 hours). Nationally, increases in the average weekly hours worked in the utilities sector (+7.4% to 41.9 hours) and information and cultural industries (+4.2% to 36.9 hours) were offset by declines in arts, entertainment and recreation (-6.5% to 24.5 hours) and health care and social assistance (-3.7% to 31.5 hours).

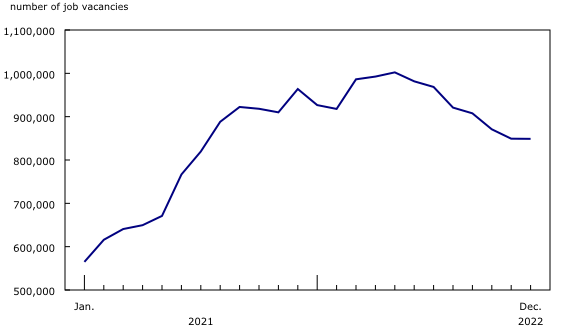

Overall job vacancies level off in December

In December, overall job vacancies (848,800) were little changed from November (849,200), levelling off after trending downward from the peak reached in May 2022 (1,002,200). (Unless otherwise stated, this release presents seasonally adjusted data.)

Decreases in the number of vacancies in transportation and warehousing (-11,700) and in finance and insurance (-5,700) were offset by an increase in health care and social assistance (+18,200), where job vacancies rebounded after a drop in November. Meanwhile, job vacancies held steady in 14 of the 20 sectors, including accommodation and food services; retail trade; construction; manufacturing; and professional, scientific and technical services.

Job vacancy rate declines since May

The job vacancy rate, which corresponds to the number of vacant positions as a proportion of total labour demand (the sum of filled and vacant positions), was 4.8% in December, unchanged compared with November but down from the record high of 5.7% observed from March to May 2022. The decrease in the job vacancy rate from May to December was the result of a fall in vacancies (-153,400; -15.3%) combined with a rise in payroll employment (+267,000; +1.6%).

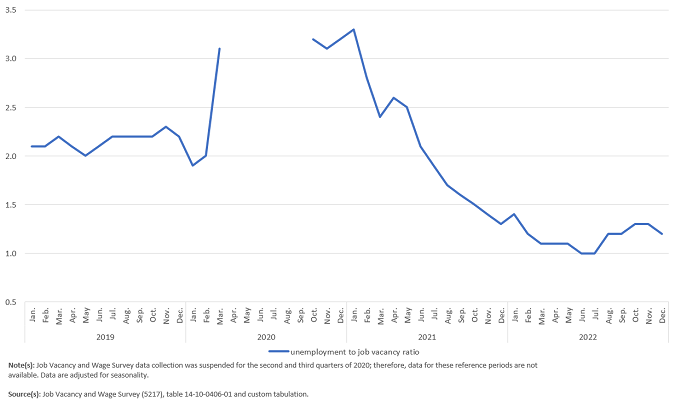

Unemployment-to-job vacancy ratio decreases slightly in December

There were 1.2 unemployed persons for every job vacancy in December 2022, down slightly from 1.3 in November, but up from the low of 1.0 in June. Before the COVID-19 pandemic, the unemployment-to-job vacancy ratio ranged between 1.9 and 3.1.

Job vacancies up in health care and social assistance

The number of job vacancies in health care and social assistance rose by 18,200 (+13.8%) to 149,800 in December, offsetting the decrease recorded in November (-19,400; -12.8%).

Job vacancies in the sector have more than doubled since the beginning of the pandemic and, in December, accounted for 17.7% of all vacancies, up from 13.6% in February 2020. Payroll employment in health care and social assistance also increased from February 2020 to December 2022, but at a much slower pace. As a result, the job vacancy rate in the sector was 6.2% in December, the third highest of any sector, and up from 3.5% in February 2020.

Job vacancies decrease in transportation and warehousing as well as finance and insurance

In transportation and warehousing, job vacancies fell (-11,700; -24.9%) to 35,400 in December 2022. This was 18,900 (-34.8%) lower than the record high reached in July (54,300). From July to December, the job vacancy rate in the sector decreased by 2.2 percentage points to 4.1%, reflecting decreases in vacancies combined with gains in payroll employment (+14,700; +1.8%). In comparison, the job vacancy rate was 3.0% in March 2020.

Job vacancies in finance and insurance decreased by 5,700 (-15.7% to 30,700) in December 2022. After peaking at 5.3% in April of the same year, the job vacancy rate fell to 3.6% in December, owing to rises in payroll employment (+30,400; +16.8%) and declines in vacancies (-13,400; -30.4%).

Job vacancies little changed in fourteen sectors

In December, job vacancies held steady in 14 sectors, including 5 sectors which together accounted for nearly half (49.0%) of all job vacancies in the month: accommodation and food services (108,800 job vacancies); retail trade (100,200); construction (77,400); manufacturing (71,700); and professional, scientific and technical services (58,100).

Job vacancies fall in four provinces

On a non-seasonally adjusted basis, job vacancies declined in Alberta (-23.1% to 74,100), Nova Scotia (-21.3% to 16,900), British Columbia (-15.7% to 113,000) and Ontario (-7.7% to 284,700) in December. Preliminary provincial data developed by Statistics Canada to remove seasonal variations indicate that these decreases in vacancies were largely attributable to seasonal patterns. Manitoba was the only province to record an increase in job vacancies (+23.4% to 25,400).

In December, British Columbia and Quebec continued to have fewer unemployed persons than job vacancies, with an unemployment-to-job vacancy ratio of 0.9 in both provinces. The ratio remained highest in Newfoundland and Labrador (4.8) (Not seasonally adjusted).

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Survey of Employment, Payrolls and Hours is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

Survey of Employment, Payrolls and Hours

With the March 30 release of January 2023 estimates, Survey of Employment, Payrolls and Hours (SEPH) will be moving to the North American Industry Classification System (NAICS) 2022 Version 1.0. As well, seasonal adjustment factors will be updated. Seasonally adjusted estimates will be revised historically back to 2001. In addition to the new industrial classification system, and new seasonal factors, historical revisions will be made for a small number of industries (four-digit level of the NAICS).

The key objective of the SEPH is to provide a monthly portrait of the level of earnings, employment and hours worked, by detailed industry, at the national, provincial and territorial levels.

Payroll employment, as measured by the SEPH, refers to the number of employees receiving pay or benefits (employment income) during a given month. The survey excludes the self-employed, owners and partners of unincorporated businesses and professional practices, and employees in the agricultural sector.

SEPH estimates are produced by integrating information from three sources: a census of approximately 1 million payroll deduction records provided by the Canada Revenue Agency; the Business Payrolls Survey, which collects data from a sample of 15,000 establishments; and administrative records of federal, provincial and territorial public administration employment, provided by these levels of government.

Estimates of average weekly earnings and hours worked are based on a sample and are therefore subject to sampling variability. This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level. Payroll employment estimates are based on a census of administrative records and are not subject to sampling variability.

With each release of SEPH data, data for the preceding month are revised. Users are encouraged to use the most up-to-date data available for each month.

Statistics Canada also produces employment estimates from its Labour Force Survey (LFS). The LFS is a monthly household survey, the main objective of which is to divide the working-age population into three mutually exclusive groups: the employed (including the self-employed), the unemployed and those not in the labour force. This survey is the official source for the unemployment rate, and it collects data on the sociodemographic characteristics of all those in the labour market.

As a result of conceptual and methodological differences, estimates of changes from the SEPH and the LFS differ occasionally. However, the trends in the data are similar. For a more in-depth discussion of the conceptual differences between employment measures from the LFS and the SEPH, refer to Section 8 of the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

Unless otherwise stated, this release presents seasonally adjusted data, which facilitate comparisons because the effects of seasonal variations are removed. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Non-farm payroll employment data are for all hourly and salaried employees and for the "other employees" category, which includes piece-rate and commission-only employees.

Unless otherwise specified, average weekly hours data are for hourly and salaried employees only and exclude businesses that could not be classified to a NAICS code.

All earnings data include overtime and exclude businesses that could not be classified to a NAICS code. Earnings data are based on gross taxable payroll before source deductions. Average weekly earnings are derived by dividing total weekly earnings by the number of employees.

Job Vacancy and Wage Survey

Beginning with the release of October 2020 data, preliminary monthly estimates from the Job Vacancy and Wage Survey (JVWS) are published on a monthly basis. These monthly estimates are available for the reference months starting from April 2015. They provide more timely information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

JVWS collection is done on a quarterly basis. The quarterly sample of business locations is allocated to the three collection months of the quarter, approximately balanced by province and by industrial sector across each of the three months. This allows both quarterly and monthly estimates to be produced.

The JVWS also provides comprehensive quarterly data on job vacancies by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions; offered hourly wages; and job vacancy characteristics. Quarterly data for the second and third quarters of 2020 are unavailable because survey operations were temporarily suspended during the COVID-19 pandemic. More information about the concepts and use of data from the JVWS is available in the Guide to the Job Vacancy and Wage Survey (75-514-G).

Preliminary monthly estimates are produced for job vacancies, job vacancy rates and payroll employment using available responses from business locations sampled in the corresponding reference month. The reference period for the JVWS is the first day of the respective month.

These preliminary monthly estimates are revised and finalized when the corresponding quarterly estimates are released or shortly thereafter. Users are encouraged to use the most up-to-date data available for each month.

Seasonally adjusted monthly job vacancy data are available online (table 14-10-0406-01). The analyses of the job vacancy levels and rates at the national level and by sector (20 broad industrial sector groups) are based on seasonally adjusted data. However, the analyses of the job vacancy levels and rates by province are based on non-seasonally adjusted data. Seasonally adjusted monthly job vacancy data by province will be available with the release of data for January 2023 on March 30, 2023.

While JVWS employment is calibrated to the SEPH, SEPH payroll employment and JVWS preliminary monthly employment figures may differ because of calibration grouping and differences in scope and reference period.

Real-time data tables

Real-time data tables 14-10-0357-01, 14-10-0358-01, 14-10-0331-01 and 14-10-0332-01 will be updated on March 13, 2023.

Next release

January 2023 data for the SEPH and the JVWS will be released on March 30, 2023. Fourth quarter (October to December) of 2022 JVWS results, which will also provide insights into job vacancies by subsector, vacancies by occupation and offered wages, will be released on March 21, 2023.

Products

More information about the concepts and use of the Survey of Employment, Payrolls and Hours is available in the Guide to the Survey of Employment, Payrolls and Hours (72-203-G).

The product "Earnings and payroll employment in brief: Interactive app" (14200001) is now available. This interactive data visualization application provides a comprehensive picture of the Canadian labour market using the most recent data from the Survey of Employment, Payrolls and Hours. The estimates are seasonally adjusted and available by province and largest industrial sector. Historical estimates that go back 10 years are also included. The interactive application allows users to explore and personalize the information presented quickly and easily. Combine multiple provinces and industrial sectors to create your own labour market domains of interest.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: