Natural resource indicators, fourth quarter 2022

Released: 2023-03-23

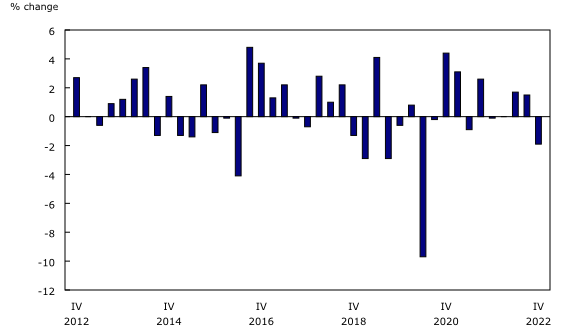

Natural resources real gross domestic product falls in the fourth quarter

Real gross domestic product (GDP) of the natural resources sector fell 1.9% in the fourth quarter, after rising 1.5% in the third quarter. In contrast, the economy-wide real GDP was unchanged in the fourth quarter.

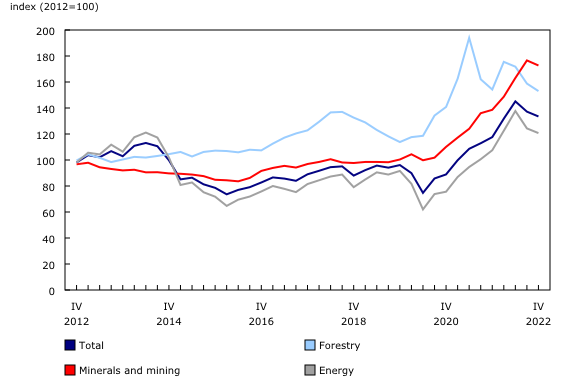

Compared with 2021, real GDP of the natural resources sector increased 2.5% in 2022, while the economy-wide real GDP rose 3.4% for the entire year. Annual real GDP of the energy subsector (+4.0%) carried the natural resources sector, whereas forestry (-1.3%) and minerals and mining (-0.9%) both decreased.

Energy

Real GDP of the energy subsector decreased 2.0% in the fourth quarter, driven by services (-6.7%) and refined petroleum products (-2.6%). Crude oil real GDP was steady (+0.3%) as production was constrained by unplanned maintenance. An oil spill in the fourth quarter, south of the border in Kansas, also disrupted the supply of Canadian crude oil to the Keystone export pipeline.

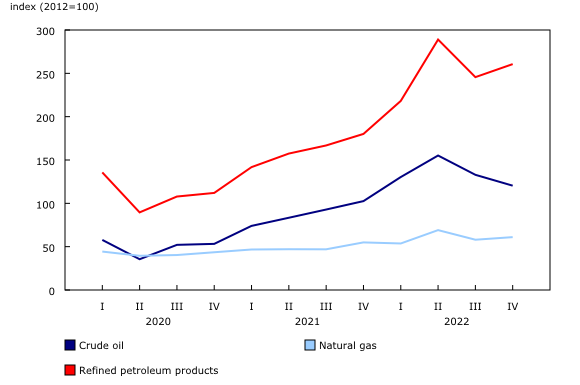

Natural resource export volumes fell 3.9% and import volumes rose 2.5% in the fourth quarter, largely influenced by volume changes in energy exports (-2.8%) and imports (+4.0%). Refined petroleum export volumes decreased 15.3%, partially due to lower exports of diesel fuel to the United States. Volumes of natural gas exports fell 5.7%, coinciding with relatively mild November temperatures in the United States, as well as rising production in that country. Exports also fell in nominal terms due to significantly decreasing prices in the fourth quarter.

Natural resource prices fell 2.7% in the fourth quarter, heavily influenced by the price of crude oil (-9.4%). The decline in total natural resource prices was also reflected in the decline in natural resource wealth in the fourth quarter. The price decline of crude oil coincided with the temporary closure in December of an export pipeline to the United States, leading to higher Canadian inventories that placed downward pressure on export prices. This was the second consecutive quarterly decrease in prices as global production was slightly in excess of global demand, among other factors.

Forestry and minerals and mining

Real GDP of the forestry subsector decreased 1.8% in the fourth quarter, mostly influenced by primary pulp and paper products (-2.8%), reflecting upstream reductions in lumber extraction (-7.6%). Minerals and mining real GDP fell 1.9%, driven by metallic minerals (-2.5%) as mining of copper, nickel, zinc, gold and silver decreased due to an extreme cold weather event affecting mines in North and Western Canada. Export volumes of the minerals and mining subsector decreased 5.1%, due to lower export volumes of coal (-9.9%) to Asian countries.

Forestry prices decreased 3.6% in the fourth quarter, led by primary sawmill and wood products (-9.4%). Higher prices among services (+5.6%) and primary pulp and paper products (+2.6%) mitigated the overall decrease for the subsector. Prices of the minerals and mining subsector fell 2.2%, largely driven by a decline in the price of metallic minerals (-7.1%) due to softening demand for iron (used in steel) amid global economic uncertainty. This decrease was partially offset by rising coal prices (+12.0%).

Natural resource prices and employment

Falling prices amplified the decline in natural resources nominal GDP (-4.5%) in the fourth quarter. The decline in natural resources activity was also reflected in a 2.3 percentage point decline in the industrial capacity utilization rate in the mining and oil and gas extraction industry as well as a 2.6 percentage point decline in the forestry and logging industry. Expressed as an annual rate, the nominal GDP of natural resources was $343.7 billion in the fourth quarter, representing 13.1% of the Canadian economy.

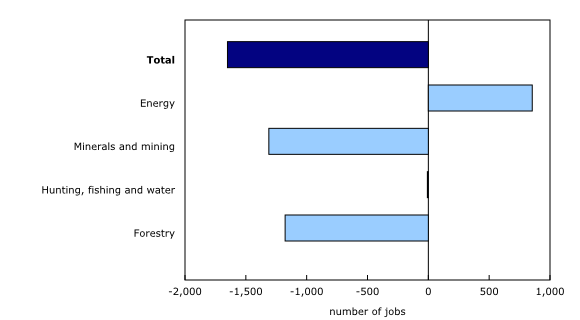

Employment changes were muted (-1,650 jobs) for the sector in the fourth quarter, with gains in the energy subsector (+850) more than offset by losses in the forestry (-1,170) and minerals and mining (-1,300) subsectors.

From the fourth quarter of 2021 to the fourth quarter of 2022, employment in the natural resources sector rose 3.3% (+20,000 jobs).

Downstream activities

The nominal GDP of downstream activities reached $11.0 billion in the fourth quarter, a 1.4% increase. Prices continued to fall (-1.5%), following a 0.5% decline in the third quarter of 2022.

Note to readers

Data on natural resources for the fourth quarter of 2022 have been released along with revised data for the first three quarters of 2022.

The natural resource indicators provide quarterly indicators for the main aggregates in the Natural Resource Satellite Account (NRSA), namely, gross domestic product, output, exports, imports, and employment. The estimates from this account are directly comparable to the estimates in the Canadian System of Macroeconomic Accounts.

Core Natural Resources: The NRSA defines natural resource activities as those that result in goods and services originating from naturally-occurring assets used in economic activity, as well as their initial processing (primary manufacturing).

Downstream Activities: Although not part of the core account, natural resources have important downstream effects on other sectors. In general, this production uses a large portion of primary manufactured products as inputs.

Employment estimates reported in this release align with the noted definitions of natural resource subsectors. Consequently, these estimates may differ from those released by the labour productivity program.

Next release

Data on natural resource indicators for the first quarter of 2023 will be released on June 22.

Products

For more information on energy in Canada, including production, consumption, international trade and much more, please visit the Canadian Centre for Energy Information website and follow #energynews on social media.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structures.

Additional information can be found in the articles "The Natural Resources Satellite Account: Feasibility study" and "The Natural Resources Satellite Account – Sources and methods," which are part of the Income and Expenditure Accounts Technical Series (13-604-M).

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: