Canadian Income Survey, 2022

Released: 2024-04-26

$70,500

2022

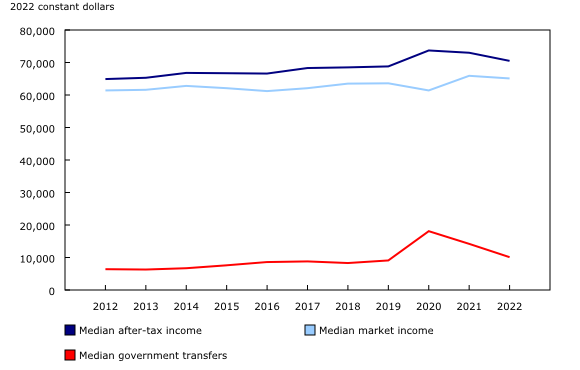

The median after-tax income of Canadian families and unattached individuals was $70,500 in 2022, a decrease from $73,000 in 2021 (-3.4%), adjusted for inflation. Despite market income remaining relatively stable, median government transfers declined in 2022, as benefits related to the COVID-19 pandemic were discontinued and pandemic-related modifications to the Employment Insurance (EI) program were removed during the year. The annual inflation rate in 2022 was 6.8%, which also contributed to the decline in income from the previous year. Dollar amounts in this analysis are expressed in constant 2022 values. Canada's official poverty rate was 9.9% in 2022, increasing by 2.5 percentage points from 7.4% in 2021 and approaching the 2019 pre-pandemic rate of 10.3%.

Improvements to the Canadian Income Survey for the 2022 reference year

The Canadian Income Survey (CIS) methods and data sources used to produce income and poverty estimates were improved with the release of the 2022 reference year estimates.

As the foremost improvement, the sample size for a large subset of the CIS content was doubled. Estimates for 2022 also reflect an improved weighting methodology and an extended target population, from people aged 16 years and older to people aged 15 years and older.

The goal of these updates is to stabilize and improve current and future income and poverty estimates and generate more reliable estimates in smaller domains for the CIS.

Refer to the article ''Improvements to the Canadian Income Survey Methodology for the 2022 Reference Year" for a detailed explanation and impact analysis of all the methodological changes to the CIS for the 2022 reference year.

Lower government transfers contribute to a decrease in after-tax income

By mid-2022, all benefits related to the pandemic were fully phased out and before the end of 2022, pandemic-related modifications to the eligibility requirements of the EI program were removed. Notably, in fall 2022 the number of insurable hours required to qualify for EI benefits in many parts of the country was raised back to the 2019 requirement. This contributed to the decrease in the number of EI recipients from 4.0 million in 2021 to 2.9 million in 2022. Similarly, the median EI income for recipients decreased by a little over 40% (from $10,100 in 2021 to $5,900 in 2022).

For Canadian families and unattached individuals, these program changes contributed to a $4,100 decline (-28.9%) in median government transfers, from $14,200 in 2021 to $10,100 in 2022. This marked the second consecutive yearly decline in median government transfers, after these transfers reached an all-time high of $18,100 in 2020. However, the 2022 amount remained above the 2019 pre-pandemic level of $9,100.

The share of government transfers in total income returned to its pre-pandemic level (13% in 2022), after two consecutive years in which these transfers represented a disproportionately high share of total income (15% in 2021 and 19% in 2020).

Median market income remained relatively unchanged in 2022, at $65,100 for Canadian families and unattached individuals. Although market income held steady in 2022, the median was higher than the pre-pandemic value of $63,600 because of the growth in 2021, which was led by employment income, as the labour market recovered from the pandemic.

With the decrease in government transfers and relatively no change in market income, the median after-tax income of Canadian families and unattached individuals was reduced to $70,500 in 2022—a drop of $2,500 (-3.4%) compared with 2021. Most provinces (7 out of 10) experienced declines in after-tax income in 2022, led by Nova Scotia (-$5,800), New Brunswick (-$4,400) and Prince Edward Island (-$3,400). The after-tax income for Quebec, Saskatchewan and Alberta remained relatively unchanged.

Repayment of benefits related to the COVID-19 pandemic

Starting in 2022, the Canadian Income Survey (CIS) collects repayments of pandemic-related benefits that were received in error or for which the eligibility criteria were not met. These repayments are identified through T1 and T4 filings, which are among the sources used for the CIS estimates. The process of recording overpayments or payments made to ineligible recipients of pandemic-related benefits in the CIS may take several years to complete. Because the repayments represent a non-discretionary expense, they were deducted from disposable income when calculating the Market Basket Measure poverty estimates.

Poverty rate approaches pre-pandemic level

According to the Market Basket Measure, Canada's Official Poverty Line, 9.9% of the population—approximately 3.8 million Canadians—lived below the poverty line in 2022, up from 7.4% in 2021. This marks the second consecutive annual increase and brings the poverty rate close to the pre-pandemic level of 10.3% in 2019.

The poverty rate for children under 18 years old increased by 3.5 percentage points to 9.9% in 2022, up from 6.4% in 2021 and comparable to the pre-pandemic level of 9.4% in 2019. For seniors aged 65 years and older, the poverty rate was 6.0% in 2022, compared with 5.6% in 2021 and the pre-pandemic level of 5.7% in 2019.

Among the provinces, Quebec had the lowest poverty rate in 2022, at 6.6%, up from 5.2% in 2021. Conversely, Nova Scotia had the highest rate, at 13.1%, up from 8.6% in 2021.

Unattached individuals are nearly four times more likely to experience poverty than those living in a family

In 2022, over one-quarter (26.0%) of unattached individuals were below the poverty line, a 4.1 percentage point increase from 2021 (21.9%) and nearly four times the 2022 poverty rate for people in families (6.6%). The 2022 poverty rates of both family types were comparable to their 2019 pre-pandemic poverty rates, at 26.9% for unattached individuals and 7.0% for people in families.

Similarly, for unattached seniors, the poverty rate (13.8%) was more than four times the rate for people in senior families (3.3%) in 2022, though the poverty rate for unattached seniors was less than half of the poverty rate for unattached non-seniors (31.0%).

Female-led one-parent families are more likely to be in poverty

After their poverty rate dropped to a low of 13.5% in 2020, nearly one-quarter (22.6%) of people living in one-parent families were below the poverty line in 2022—a proportion similar to the 2019 pre-pandemic level of 22.0%. People in female-led one-parent families were almost four times more likely (23.8%) to live below the poverty line than people in couple families with children (6.3%).

Racialized groups are more likely to live below the poverty line

In 2022, the poverty rate for individuals who are members of racialized groups was 13.0%, up 3.5 percentage points from 2021 (9.5%). The 2022 poverty rates for the three largest racialized groups in Canada were 11.5% for South Asian Canadians, 15.6% for Chinese Canadians and 13.9% for Black Canadians.

Among the other racialized groups, Filipino Canadians were the only group less likely to experience poverty than non-racialized Canadians, at a rate of 6.2%, but this was an increase of 3.3 percentage points from 2021 (2.9%). About 81% of Filipino Canadians lived in families with two or more earners, compared with 55% of non-racialized Canadians. Having more earners in the family was strongly associated with lower poverty rates.

The gap between Indigenous and non-Indigenous people is widening

In 2022, 17.5% of the Indigenous population aged 15 years and older lived below the poverty line. This is nearly double the poverty rate of the non-Indigenous population (9.6%). Although this 7.9 percentage point difference represents the second consecutive year of a widening gap, the gap is still smaller than it was before the pandemic in 2019. The poverty rate among First Nations people aged 15 years and older living off reserve was 22.1% in 2022, nearly double the rate for Métis (11.9%). Separate estimates for Inuit could not be published because of a smaller sample.

People with a disability are at a higher risk of poverty

In 2022, 12.3% of people with a disability aged 15 years and older lived below the poverty line, a 1.7 percentage point increase from 2021 (10.6%). Despite this increase, the rate was still lower than it was in 2019 (13.7%), before the pandemic.

Similar to the trend observed for the overall population, unattached individuals with a disability aged 15 years and older (29.4%) were more than four times as likely to experience poverty as those in families (7.3%).

Recent immigrants face higher poverty rates, but these remain lower than before the pandemic

In 2022, 10.7% of immigrants aged 15 years and older lived below the poverty line, a 2.6 percentage point increase from 2021 (8.1%). The more recent an immigrant's arrival, the more likely they are to be below the poverty line. For example, the poverty rate in 2022 for immigrants who arrived within the previous 10 years was 14.0%, while the poverty rate for immigrants who arrived within the previous 5 years was 16.4%.

By comparison, 8.6% of the Canadian-born population aged 15 years and older lived below the poverty line in 2022.

The low-income measure is increasing at a steady rate and is similar to the pre-pandemic level

Statistics Canada also reports low income based on the low-income measure. The Canadian low-income rate increased by 1.3 percentage points for a second consecutive year, rising from 10.6% in 2021 to 11.9% in 2022. The 2022 low-income rate was little changed from the pre-pandemic level of 12.1% in 2019.

Food insecurity increases

In 2022, approximately 8.7 million people, or 22.9% of the population, lived in households that reported some form of food insecurity. This is an increase of just under 1.8 million from the previous year, when the rate was 18.4%, and marks the second consecutive year of increases since the beginning of the pandemic. The proportion of those who were marginally food insecure remained relatively stable, at 6.0%, while the proportions of those who were moderately (10.9%) and severely (6.0%) food insecure both increased.

People in one-parent families (43.4%) and unattached non-seniors (30.5%) remained at a particularly high risk of food insecurity. People in non-senior couples (17.9%) and couples with children (24.7%) had somewhat lower rates, though all were higher than the rates for people in senior families (10.8%) or unattached seniors (13.4%).

Food insecurity data was collected during the Canadian Income Survey interview, which was conducted from January to June 2023, and is being released with the reference year 2022 income estimates. Food insecurity is the inadequate or insecure access to food due to financial constraints, and refers to the 12-month period prior to the interview. Statistics Canada refers to these as 2022 estimates, but some users may prefer to use the more precise timing of January to June 2023.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

This release covers only the 10 provinces. The release of 2022 results for the territories from the Canadian Income Survey (CIS) is scheduled for June 2024.

The CIS estimates are based on probability samples and are therefore subject to sampling variability, especially for smaller groups and geographies. As a result, year-to-year estimates will show more variability than trends observed over longer periods.

In this release, differences between estimates are statistically significant at the 95% confidence level unless otherwise noted.

Definitions

An economic family refers to a group of two or more persons who live in the same dwelling and are related to each other by blood, marriage, common-law union, adoption or a foster relationship. This concept differs from the census family concept used in the Annual Income Estimates for Census Families and Individuals.

Senior families refer to families in which the highest income earner is aged 65 years and older.

Non-senior families refer to families in which the highest income earner is under 65 years old.

Couples without children refer to non-senior couples without children.

Indigenous people refers to persons aged 15 years and older (persons aged 16 years and older for years prior to 2022) who self-identified as First Nations (North American Indian), Métis or Inuk (Inuit).

Racialized group is derived directly from the concept of visible minority. A visible minority refers to whether a person is a visible minority or not, as defined by the Employment Equity Act. This act defines visible minorities as "persons, other than Indigenous peoples, who are non-Caucasian in race or non-white in colour." The visible minority population consists mainly of the following groups: South Asian, Chinese, Black, Filipino, Arab, Latin American, Southeast Asian, West Asian, Korean and Japanese. Measurement for population groups designated as visible minorities started in 2020.

Immigrants refers to people who are, or have been, landed immigrants in Canada. A landed immigrant is a person who has been granted the right to live in Canada permanently by immigration authorities. Canadian citizens by birth and non-permanent residents (persons from another country who live in Canada and have a work or study permit, or are claiming refugee status, as well as family members living here with them) are not landed immigrants.

Persons with a disability refers to persons aged 15 years and older (persons aged 16 years and older for years prior to 2022) who met the disability screening questions criteria.

This release analyzes income on the basis of medians. The median is the level of income at which half the population had higher income and half had lower income. Income estimates are expressed in 2022 constant dollars to factor in inflation and enable comparisons across time in real terms.

After-tax income is the total of market income and government transfers, less income tax.

Market income consists of employment income and private pensions, as well as income from investments and other market sources.

Government transfers include benefits such as Old Age Security, the Guaranteed Income Supplement, the Canada Pension Plan and the Quebec Pension Plan, Employment Insurance, social assistance, the goods and services tax credit, provincial tax credits, and child benefits.

For 2020, 2021 and part of 2022, government transfers included emergency response and recovery benefits in response to the COVID-19 pandemic.

The low-income measure defines an individual as having low income if their household's adjusted after-tax income falls below 50% of the median adjusted after-tax income.

The Market Basket Measure is based on the cost of a specific basket of goods and services representing a modest, basic standard of living. It includes the costs of food, clothing, footwear, transportation, shelter and other expenses for a reference family. These costs are compared with the disposable income of families to determine whether they fall below the poverty line. For more information please see, Report on the second comprehensive review of the Market Basket Measure.

Food insecurity is the inadequate or insecure access to food due to financial constraints. Food insecurity in this release refers to people living in households that experienced marginal, moderate or severe food insecurity.

Products

The infographics "Income of Canadians, 2022" and "Canada's Official Poverty Dashboard of Indicators: Trends, April 2024" are now available.

The article "Improvements to the Canadian Income Survey Methodology for the 2022 Reference Year" is now available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: