Study: Manufacturing: The year 2013 in review

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2014-09-22

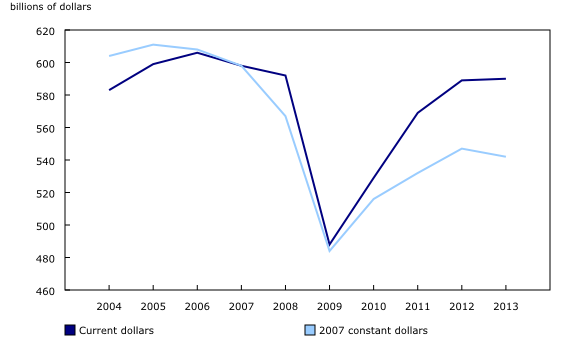

Canadian manufacturing sales increased in 2013 for the fourth year in a row. Sales edged up 0.3% and have almost fully recovered from the recession of 2008-2009. By contrast, constant dollar sales fell 0.9% year over year, indicating a drop in volumes. Constant dollar sales in 2013 remained well below pre-recession levels.

Wood product industry leads sales gains

In 2013, four industries accounted for over three-quarters of the overall increases: wood, food, aerospace product and parts, and chemical manufacturing.

The wood product industry had the largest gain in sales, increasing $3.6 billion from 2012 to $23.8 billion (+17.8%) in 2013. Since the recession of 2008-2009, improved economic conditions and increased exports to the United States and China have contributed to higher sales for the Canadian wood products industry.

The food manufacturing industry posted the second highest increase in 2013, with current dollar sales rising $2.5 billion to $88.8 billion (+2.9%). In contrast to most industries, the food manufacturing industry saw its sales increase through the downturn of 2008-2009. Sales in this industry have risen in 18 of the past 20 years.

The industries posting the largest declines in 2013 included primary metals, petroleum and coal products, fabricated metal products, and automotive (the motor vehicle assembly and motor vehicle parts industries combined).

Manufacturing sales for the primary metal industry were down $2.4 billion to $43.4 billion in 2013 (-5.3%), mostly as a result of lower prices. Sales for the petroleum and coal product industry recorded a 2.8% decline to $82.7 billion, largely due to lower volumes. This was the result of extended and unplanned shutdowns at several refineries in 2013.

Sales up in seven provinces

Higher sales were posted by seven provinces in 2013 with Alberta leading the way, followed by Saskatchewan and British Columbia. Alberta's gain of $2.1 billion to $73.8 billion (+3.0%) was primarily due to increased sales in the chemical, petroleum and coal product, as well as the wood product industries. Alberta supplanted Ontario as the third largest manufacturer of wood products in 2013, behind British Columbia and Quebec.

Manufacturers in Saskatchewan increased sales by $1.4 billion to $15.7 billion (+9.7%), on the basis of higher sales of non-durable goods such as petroleum and coal products, and food.

Conversely, sales declined in Quebec (-1.3%), Nova Scotia (-10.0%), and Newfoundland and Labrador (-12.8%). In all three provinces, the declines were concentrated in the non-durable goods industries.

Unfilled orders and inventories advance

In 2013, unfilled orders rose 13.2% to $71.7 billion, led by orders for transportation equipment. Unfilled orders for aerospace product and parts increased 31.0% to $40.7 billion. By the end of 2013, the share of aerospace unfilled orders out of total manufacturing unfilled orders had risen to 56.7% from a 10-year low of 33.4% in 2005.

Total inventory levels increased 3.3% to $68.5 billion in 2013. The largest dollar increase in inventories was seen in the petroleum and coal product industry, which posted a gain of $1.3 billion (+22.6%). Inventories also rose substantially in the transportation equipment industry, particularly aerospace product and parts, which posted a gain of $1.1 billion (+18.0%).

Manufacturing employment down while labour productivity and compensation rise

The manufacturing sector employed 1.5 million people in 2013, according to the Survey of Employment, Payrolls and Hours. This was down 11,700 persons from 2012 (-0.8%). Quebec posted the largest decline with a loss of 11,200 employees.

The labour productivity index increased 0.7% in 2013, following annual increases every year since 2009. Total compensation per hour worked also increased, posting a 2.3% gain year over year in 2013.

Capital expenditures increase

Capital expenditures in manufacturing edged up 0.5% to $18.1 billion in 2013, following gains of 12.8% in 2011 and 1.9% in 2012. The recent slowdown in the growth of capital expenditures follows a pattern similar to the declining sales gains seen in the manufacturing sector.

Overview

In 2013, current dollar sales were essentially flat year over year and were only slightly below pre-recession levels. However, from a constant dollar perspective, sales were down in 2013 and remained well below pre-recession levels.

Results for other key economic indicators in 2013 were mixed. While the manufacturing sector has recovered from the recession according to some indicators, other indicators were still well below pre-recession levels.

The analytical article "Manufacturing: The Year 2013 in Review" is now available as part of the Analysis in Brief series, no. 91 (Catalogue number11-621-M). From the Browse by key resource module of our website, choose Publications.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca).

To enquire about the concepts, methods or data quality of this release, contact Michael Schimpf (613-951-9832; michael.schimpf@statcan.gc.ca), Manufacturing and Wholesale Trade Division.

- Date modified: