Distributions of household economic accounts for income, consumption, saving and wealth of Canadian households, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-03-22

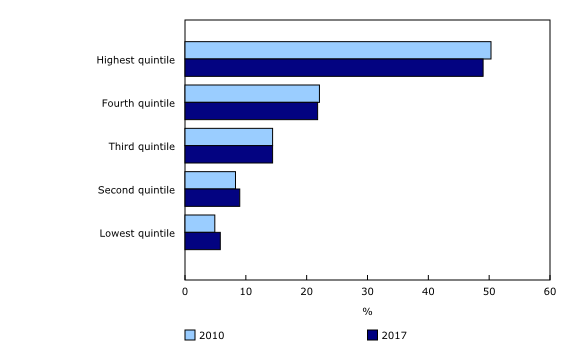

Share of wealth held by highest income earners down since 2010

New estimates from Distributions of Household Economic Accounts indicate that in 2017, the top 20% of income earners held 49.0% of household wealth, down from 50.3% since 2010. The lowest two quintiles increased their share of household wealth between 2010 and 2017.

Wealth for households in the highest income quintile is 2.5 times higher than the overall average. The top 20% of income earners had a net worth of $1.8 million per household in 2017, compared with about $214,000 for the bottom 20%.

There were larger changes in the distribution of wealth by province. More wealth was in Ontario and British Columbia in 2017 than in 2010.

Households with a major income earner aged 55 to 64 continued to hold the most wealth of all age categories as they accumulated assets for retirement. These households held an average of $1.2 million in 2017, and their share of overall wealth increased from 27.0% in 2010 to 30.9% in 2017. That increase reflects the growing representation of this age group in the Canadian population, as well as higher than average increases in the value of real estate and other non-financial assets.

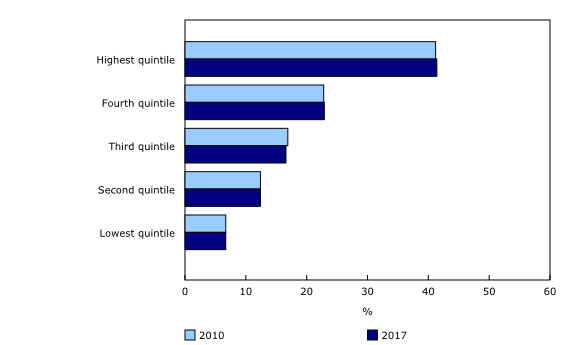

Distribution of income and consumption relatively stable over time

The top 20% income-earning households earned 41.4% of all household disposable income in 2017, while the bottom 20% earned 6.7% of total household disposable income. On average, those in the top income quintile earned $164,117 per household, while those in the bottom income quintile earned $26,513 per household.

As was the case for wealth, relatively more of Canada's household disposable income was concentrated in British Columbia in 2017 than in 2010, while incomes in Alberta have declined in recent years, from $104,643 per household in 2015 to $94,788 in 2017, in tandem with economic conditions in the oil and gas sector.

By age group, household disposable income was highest for those households with a major income earner aged 45 to 54, at $97,999 per household (24% higher than the overall average).

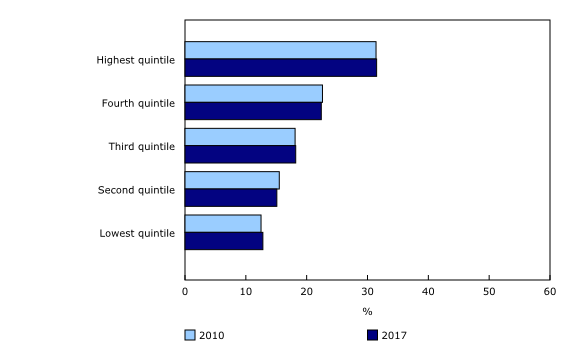

Final consumption expenditure across Canadian households is more evenly distributed than disposable income. The top 20% income-earning households undertook 31.5% of total household consumption expenditure in 2017, while the bottom 20% spent 12.8%.

Net saving, or the difference between current income and consumption, averaged $2,812 per household in 2017. Households in the top income quintile saved an average of $45,438, while those in the bottom spent on average more than they earned, resulting in a net dissaving of $23,996 per household.

It should be noted that some individuals in the bottom quintile may have significant wealth, such as retired individuals who have a large stock of retirement assets. For these individuals, the negative saving reflects the drawing down of wealth in retirement.

The saving of households in the top quintile contributed to increases in wealth, while the dissaving of those in the bottom quintile dampened these increases.

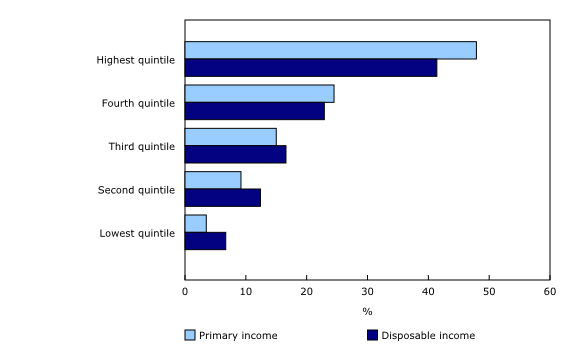

Transfers redistribute income from highest to lower quintiles

Government transfers – such as progressive income tax regimes, Old Age Security, the Canada Pension Plan, Employment Insurance, and social assistance programs – redistribute income across Canadian household groups. In addition to those transfers, transfers to households through government- and employer-sponsored pension funds redistribute income to retirees drawing on pension assets.

Household primary income – which includes wages and salaries, employer-paid benefits, self-employment income, rental income, and income from investments – represents household income before any transfers (either received or paid) are taken into account. The bottom 20% of income earners received 3.5% of total household primary income in 2017. Once transfers were taken into account, their share of household income increased to 6.7%.

In the case of the top 20% of income earners, the opposite impact was observed. Prior to taking transfers into account, the top 20% of income earners held 47.9% of primary income in 2017. Once transfers were accounted for, their share of income decreased to 41.4%.

Note to readers

Statistics Canada regularly publishes macroeconomic indicators on household disposable income, final consumption expenditure, net saving and wealth as part of the Canadian System of Macroeconomic Accounts (CSMA). These accounts are aligned with the most recent international standards and are compiled for all sectors of the economy, including households, non-profit institutions, governments and corporations along with Canada's financial position vis-à-vis the rest of the world. While the CSMA provide high quality information on the overall position of households relative to other economic sectors, the Distributions of Household Economic Accounts (DHEA) help provide additional granularity to address questions such as vulnerabilities of specific groups and the resulting implications for economic wellbeing and financial stability, and are an important complement to standard quarterly outputs related to the economy.

Indicators cited in this release include: quintile, or household disposable income quintile, which is equivalized to the number of consumption units per household; and net saving, derived from unequivalized household disposable income less household final consumption expenditure plus the value of pension entitlements.

Data availability and sources and methods

The DHEA data are available to users through CANSIM tables 378-0150, 378-0151, 378-0152, 378-0153, 378-0154 and 378-0155. Also included in this release are estimates of household counts by demographic characteristic, available through CANSIM table 378-0156. Details on the sources and methods behind these estimates can be found under "Distributions of Household Economic Accounts" in Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X).

Products

The article "Distributions of Household Economic Accounts, estimates of asset, liability and net worth distributions, 2010 to 2017, technical methodology and quality report," which is part of the Income and Expenditure Accounts Technical Series (13-604-M), is available.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

Details on the sources and methods behind these estimates can be found in Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X). See section "Distributions of Household Economic Accounts" under Satellite Accounts and Special Studies.

The System of Macroeconomic Accounts module features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: