Gross domestic product by industry, April 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-30

April 2020

-11.6%

(monthly change)

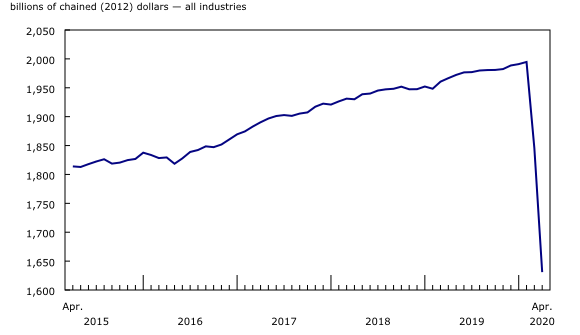

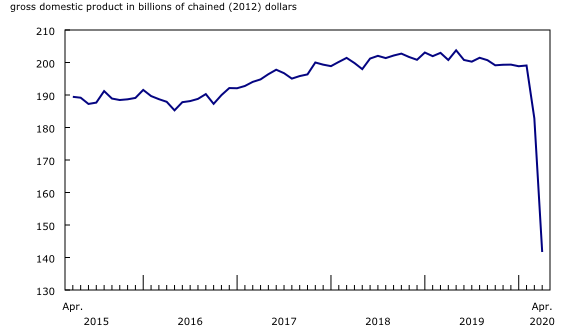

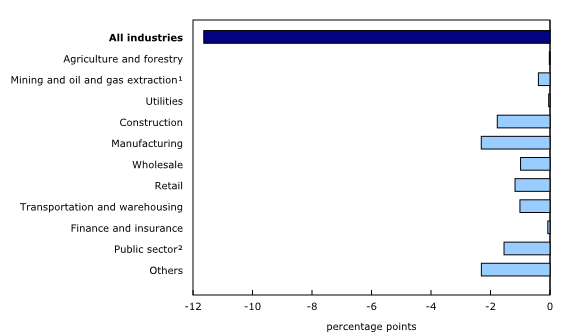

Real gross domestic product (GDP) dropped 11.6% in April, following a 7.5% decline in March. April marked the first full month of measures put in place to slow the spread of COVID-19. All 20 industrial sectors of the Canadian economy were down, producing the largest monthly decline since the series started in 1961. The economy was 18.2% below its February level, the month before the COVID-19 measures began.

Given the unprecedented economic situation brought on by the COVID-19 pandemic and the demand for trusted information, Statistics Canada continues to provide an advanced aggregate indicator of the state of the Canadian economy. Preliminary information indicates an approximate 3.0% increase in real GDP for May. Output across several industrial sectors—including manufacturing, retail and wholesale as well as the public sector (health, education and public administration)—increased in May, as activities gradually resumed in phases depending on the type of activity and the geographic area. Owing to its preliminary nature, this estimate will be revised on July 31 with the release of the official monthly GDP for May reference month.

Manufacturing sector continues to drop

In April, the manufacturing sector dropped 22.5% as all subsectors contracted. Responding to local and provincial emergency measures introduced to slow down the spread of COVID-19, many factories were either completely shut down or operated at a much lower capacity; the reduced manufacturing activity was indicated by a drop in the capacity utilization rate reported by the Monthly Survey of Manufacturing. Over four-fifths of establishments in the manufacturing sector reported that their activities were affected by COVID-19.

Durable manufacturing fell 29.2% in April, following a 13.1% decrease in March, largely due to a 49.6% drop in transportation equipment manufacturing. In light of the continued closure of automotive plants on both sides of the Canada–US border, the output of motor vehicle (-97.7%) and motor vehicle parts manufacturing (-86.4%) plummeted in April. Aerospace product and parts manufacturing was down 10.6%, reflecting continued lower demand from airlines, as non-essential air travel came to a standstill. Fabricated metal products (-27.7%) and machinery manufacturing (-17.2%) also posted notable declines.

Non-durable manufacturing decreased 15.4% in April. After a notable increase in March, food manufacturing (-12.8%) contributed the most to the decline in April. This was largely due to lower output of meat product manufacturing, as some meat processing plants temporarily closed their doors following COVID-19 outbreaks at their facilities. Plastic and rubber products manufacturing was down by one-third. Petroleum and coal products manufacturing contracted by nearly one-quarter as refineries continued curtailing their production in response to a global oversupply of oil, falling prices and lower demand for energy products.

Construction continues to decline

The construction sector fell 22.9% in April, as all types of construction activity were down. Non-residential construction fell 36.0%, as commercial, public and industrial construction all posted double-digit contractions. Declines were largely concentrated in Ontario and Quebec. The 22.3% decrease in residential construction was driven by lower home alterations and improvements, and declines in multi-family dwellings and single family homes construction. Engineering construction (-17.2%) and repair construction (-25.4%) were also down.

Retail trade down

Retail trade contracted 22.9% in April, following a 9.2% decline in March, as activity at traditional brick-and-mortar stores decreased in all subsectors. Motor vehicle and parts dealers contributed most to the decline with a 41.8% contraction, as people stayed out of showrooms and service-bays even though car dealerships were deemed an essential service and remained open in many parts of the country. Retailing activity at clothing and clothing accessories stores plunged by more than two-thirds in April while the activity at sporting goods, hobby, book and music stores fell by half, as malls and stores remained shut in response to mandatory closures of non-essential businesses. Health and personal care stores (-18.3%), general merchandise (-17.2%), and food and beverage stores (-14.3%) were down in the month following increases in March, when Canadians were stocking up supplies for a period of self-isolation and physical distancing. Retailing activity at gasoline stations fell 18.3%, despite a continued decline in energy prices as reported by the Consumer Price Index, as household and business demand remained low. Only activity at non-store retailers (+17.3%) rose in April. This growth was spurred by a continued increase in the use of online shopping services by Canadians—given the closures of brick-and-mortar stores to in-store shopping—and by increased overall demand from consumers.

Transportation and warehousing continues to decline

The transportation and warehousing sector was down for the fifth time in six months, dropping 23.1% in April, as border closures and travel restrictions continued affecting the sector.

Air transportation plummeted 93.7%, reflecting lower movement of both goods and passengers, as domestic and international air travel came to a standstill by the end of April. All of Canada's major airline carriers either completely ceased operations or greatly reduced them in April.

Trucking (-19.5%) and support activities for transportation (-23.2%) were down, as continued economy-wide closures and lower business activity reduced to varying degrees the demand for these services.

Transit and ground passenger transportation and scenic and sightseeing transportation declined by half in April, as all industries were down. The output of urban transit systems dropped by three-quarters as declining ridership and reduced service offerings by transit corporations continued into April.

Warehousing (+2.2%) and postal and courier services (+3.0%) rose in April, as a growth in online shopping spurred demand for these services. A number of postal and courier services providers reported 'holiday-like' atypical volumes of parcels in April.

Accommodation and food services down, as were the arts and entertainment sector

The output of the accommodation and food services sector dropped 42.4% in April, following a 37.1% decline in March. The sector was down approximately 64% from its level of activity in February 2020.

The food services and drinking places subsector plunged 40.8%, as all types of restaurants and drinking places remained closed in response to local and provincial states of emergency, or only operated at a greatly reduced capacity providing exclusively take-out and delivery service.

Accommodation services fell 45.7% in April, as the extended restrictions on international and interprovincial travel kept demand for these services suppressed.

The arts and entertainment sector (-25.6%), a large contributor to activity in both accommodation and food services, was down again in April. COVID-19 kept professional sports on the sidelines, with increasing uncertainty as to any return to play in arenas and stadiums with spectators in the coming months. The National Hockey League, National Basketball Association, Major League Baseball and Major League Soccer cancelled all games in April, continuing season postponement decisions made in mid-March as a result of the global pandemic.

Wholesale trade declines

Wholesale trade fell 17.9% in April, the largest decline since the series started in 1961, as eight of the nine subsectors were down. According to data from the Wholesale Trade Survey, four-fifths of establishments in the wholesale trade sector indicated their activities had been affected by COVID-19.

The output of motor vehicle and motor vehicle parts and accessories merchant wholesalers were down by half in April and contributed most to the overall decline in the sector, as the shuttering of North America's automotive assembly plants reduced the need for cross-border movement of parts and products. Building materials and supplies wholesaling contracted 21.8%, as the demand for materials declined owing to lower construction and renovation activity. Personal and household goods wholesaling declined 19.1% and pharmaceutical wholesaling dropped, following a strong increase in March.

Public sector continues to contract

The public sector (education, health care and public administration) fell 7.7% in April, as all three components were down in response to ongoing stay-at-home orders aimed at slowing the spread of COVID-19.

Health care services dropped 10.4%, as all types of health and social services were down. A 23.9% decrease in ambulatory healthcare services contributed the most to the decline as offices of physicians, dentists, diagnostic labs etc. remained closed through April. Hospital services were down 2.2%.

Educational services fell 8.6%, with a steep decline in elementary and secondary schools (-12.9%) as teachers, schoolboards and families continued to adapt to online learning following the suspension of classes by all provinces and territories in March.

Public administration decreased 4.3% in April. Municipal and provincial government administration were down respectively by 11.7% and 2.4%, as services and offices remained closed or reduced their hours of operation. In contrast, federal government administration was up 1.9% in April, as increased teleworking capabilities allowed many services to resume with most employees working from home.

Real estate keeps declining

Real estate declined 3.5% in April following a 1.2% decline in March. Activity at the offices of real estate agents and brokers plunged 57.2% in April, as home resale activity in nearly all major urban centres came to a standstill. The stay-at-home orders combined with uncertain employment prospects and deteriorating economic conditions kept many prospective buyers and sellers away from the transaction market.

Mining, quarrying and oil and gas extraction declines

Mining, quarrying and oil and gas extraction decreased 9.4% in April, as all subsectors were down. Mining excluding oil and gas extraction declined 23.0% as all types of mining activities were down, except for potash (+9.2%). Weakness in oil prices and a global oversupply, along with measures put in place to slow the spread of COVID-19 contributed to a 19.3% decline in support activities for mining, and oil and gas extraction, and to a 1.8% decrease in oil and gas extraction.

Finance and insurance down

The finance and insurance sector declined 1.0% in April. Insurance carriers and related services were down 9.3%, as insurance carriers started reducing premiums and issuing rebates to customers.

Following increased activity across global stock markets in March, financial markets remained active in April, but to a lesser extent. Measures taken by policy makers and central banks in March and April provided a sense of assurance to market participants. The Bank of Canada cut overnight lending rate three times by end of the March and established several large-scale asset purchase programs to increase liquidity in core funding markets. An increase in financial investment services, funds and other financial vehicles (+4.4%) and growth in banks and other depository intermediation (+1.7%) were registered in April.

Other industries

Personal and laundry services (services provided by hair salons, beauty parlors, funeral homes, laundry services etc.) dropped 39.3%, while private households (services provided by maids, cooks, gardeners etc.) fell more than one-third, reflecting mandatory closures of all non-essential businesses and services across Canada in April.

Utilities decreased 1.8% in April, as electric power generation, transmission and distribution (-2.0%) and natural gas distribution (-1.0%) were down.

Professional services were down 1.3%, as gains in legal (+2.6%), accounting (+0.9%) and computer systems design and related services (+2.1%) were more than offset by lower advertising (-19.6%) and other professional, scientific and technical services, including scientific research and development (-6.5%).

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2016).

For the period starting in January 2017, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2016 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2019.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on July 13.

Next release

Data on GDP by industry for May will be released on July 31.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Ederne Victor (613-863-6876), Industry Accounts Division.

- Date modified: