Wholesale trade, November 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-01-19

$67.4 billion

November 2020

0.7%

(monthly change)

$356.7 million

November 2020

0.9%

(monthly change)

$89.3 million

November 2020

1.5%

(monthly change)

$927.0 million

November 2020

-0.6%

(monthly change)

$627.3 million

November 2020

0.4%

(monthly change)

$12,575.4 million

November 2020

0.6%

(monthly change)

$35,012.6 million

November 2020

0.2%

(monthly change)

$1,621.2 million

November 2020

4.7%

(monthly change)

$2,464.5 million

November 2020

2.6%

(monthly change)

$6,643.5 million

November 2020

2.1%

(monthly change)

$7,052.2 million

November 2020

0.2%

(monthly change)

$13.3 million

November 2020

-0.5%

(monthly change)

$20.4 million

November 2020

-9.2%

(monthly change)

$14.0 million

November 2020

14.9%

(monthly change)

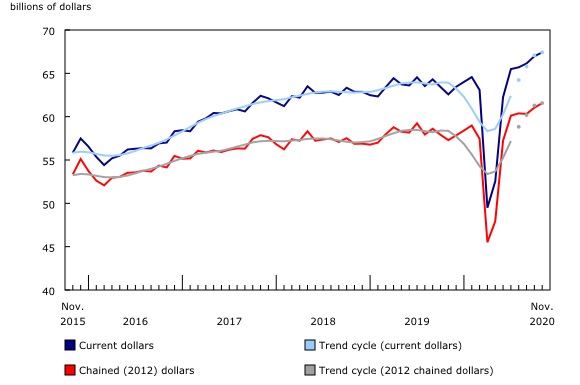

Wholesale sales grew for the seventh consecutive month in November—up 0.7% to an all-time high of $67.4 billion. Five of seven subsectors reported stronger sales, led by the machinery, equipment and supplies subsector and the building material and supplies subsector. Notably, the increase reflects higher domestic sales of Canadian goods, as both imports and exports of key commodities fell in November.

Wholesale trade volumes increased 0.9% in November.

Wholesale sector continues to show strength

The demand for wholesale goods largely held firm through November as sales grew for the seventh consecutive month. This occurred notwithstanding the fact that some restrictions on business activities started to be tightened in some provinces in November in response to the second wave of COVID-19. However, for the most part, significant restrictions did not come into effect until December.

November sales were 4.4% higher than the pre-pandemic level recorded in February 2020, with six of the seven subsectors' sales higher than pre-COVID-19 levels. Additionally, all subsectors posted sales in November 2020 that were higher than in November 2019, as was the case for October 2020 compared with October 2019.

The performance of the machinery, equipment and supplies subsector, as well as the building material and supplies subsector, has been the foundation of the recovery in the wholesale sector since the spring. This may be in part because the products sold by companies in these subsectors (e.g., computers and electronics, smart phones, home renovation materials, large machinery) are tied closely to activities and businesses that have been allowed to continue or have been in high demand during the pandemic.

At $1.3 billion above February 2020 levels, sales in the machinery, equipment and supplies subsector have surpassed pre-COVID-19 levels by more than any other subsector, followed by the building material and supplies subsector at $1.1 billion above pre-COVID-19 levels. As has been the case throughout the pandemic, the motor vehicle and motor vehicle parts and accessories subsector remains the furthest behind, and the only subsector whose November sales were not higher than pre-pandemic levels.

Sales rise in five subsectors

Five of the seven wholesale subsectors reported higher sales in November, representing more than 80% of the sector. The increases came despite weaker imports and exports of key products.

Sales of machinery, equipment and supplies rose 2.8% to $14.3 billion. This was the fourth increase in the past six months, bringing total sales to their highest level on record. Three of the four industries in the subsector reported gains. Higher sales in this subsector reflect greater domestic sales as exports of industrial machinery, equipment and parts fell 0.7% in November.

Sales of building material and supplies rose 1.1% to $10.2 billion, the sixth increase in the past seven months, reaching a record high in November. The increase reflects primarily higher sales in the lumber, millwork, hardware and other building supplies industry, which makes up more than half of the subsector. It appears that this increase was also driven by stronger domestic sales as exports of lumber and other sawmill products fell approximately 10% in November.

Sales of motor vehicles and motor vehicle parts and accessories fell 1.8% to $11.1 billion—the first decline after six months of gains. Despite the decline, sales were 5.6% higher than in November of 2019. As in the other subsectors, the domestic market was a source of the higher sales of motor vehicles and motor vehicle parts and accessories as exports fell 4.1% in November.

Higher sales in nine provinces

Sales increased in nine provinces in November, accounting for more than 98% of total wholesale sales. Alberta, Ontario and Quebec led the gains, while Nova Scotia was the only province that posted a slight decrease for the month.

Alberta sales rose 2.1% to $6.6 billion—its second straight month of growth. Higher sales were recorded in four of the seven subsectors, led by a 7.7% increase in the machinery, equipment and supplies subsector. After three months of declining sales, the subsector posted its second consecutive month of gains, with increases in all industries.

Sales in Ontario continued to rise in November, up 0.2% to $35.0 billion—the third consecutive increase and the sixth in the past seven months. The building material and supplies subsector and the miscellaneous subsector led the gains for Ontario, more than offsetting the lower sales in the other five subsectors. The building material and supplies subsector posted higher sales across all three of its industries for the second month in a row. The motor vehicle and motor vehicle parts and accessories subsector mitigated the increase in Ontario.

Quebec sales increased 0.6% to $12.6 billion in November. Higher sales were recorded in five of the seven subsectors. The personal and household goods subsector rose 2.8% to $2.7 billion, led by strong growth in the pharmaceuticals and pharmacy supplies industry in November. The building material and supplies subsector (+1.3% to $2.0 billion) built off the strength in the metal service centres industry and the lumber, millwork, hardware and other building supplies industry. Conversely, a decrease of 2.2% to $1.3 billion in the miscellaneous subsector was headed by weak sales in the chemical (except agricultural) and allied products industry and the recyclable material industry.

Nova Scotia was the only province to post a decline in November, as sales fell 0.6% to $927 million. The food, beverage and tobacco subsector (-4.8% to $302 million) posted the largest decline in the province, reflecting a sharp decline in the sale of fish and seafood products.

Inventories fall for a second month

Wholesale inventories fell for the second month in a row. November inventories decreased 0.6% to $89.6 billion—its lowest level since March 2019.

Lower inventories were reported in all seven subsectors in November. The machinery, equipment and supplies subsector posted the largest decreases—down 1.1% to $26.6 billion. Decreases in the inventory of the construction, forestry, mining, and industrial machinery, equipment and supplies industry more than offset the gains in the three other industries within the machinery, equipment and supplies subsector.

The personal and household goods subsector's inventories fell 0.6% to $15.9 billion in November. The home furnishings industry and the toiletries, cosmetics and sundries industry led the decreases in inventories for this subsector.

The inventory-to-sales ratio fell for the second straight month to 1.33 for November—the lowest level since May 2018. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Note to readers

All data in this release are seasonally adjusted and expressed in current dollars, unless otherwise noted.

Seasonally adjusted data are data that have been modified to eliminate the effect of seasonal and calendar influences to allow for more meaningful comparisons of economic conditions from period to period. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Trend-cycle estimates are included in selected charts as a complement to the seasonally adjusted series. These data represent a smoothed version of the seasonally adjusted time series and provide information on longer-term movements, including changes in direction underlying the series. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Both seasonally adjusted data and trend-cycle estimates are subject to revision as additional observations become available. These revisions could be large and could even lead to a reversal of movement, especially for reference months near the end of the series or during periods of economic disruptions.

Total wholesale sales expressed in volume are calculated by deflating current dollar values using relevant price indexes. The wholesale sales series in chained (2012) dollars is a chained Fisher volume index, with 2012 as the reference year. For more information, see Deflation of wholesale sales.

The Monthly Wholesale Trade Survey covers all industries within the wholesale trade sector, as defined by the North American Industry Classification System (NAICS), with the exception of oilseed and grain merchant wholesalers (NAICS 41112); petroleum and petroleum products merchant wholesalers (NAICS 412); and business-to-business electronic markets, and agents and brokers (NAICS 419).

Real-time data tables

Real-time data tables 20-10-0019-01, 20-10-0020-01 and 20-10-0005-01 will be updated soon.

Next release

Wholesale trade data for December 2020 will be released on February 12, 2021.

Products

The product "Monthly Wholesale Trade Survey: Interactive Tool" (71-607-X) is now available online. This product is based on the data published in the tables of the Monthly Wholesale Trade Survey: 20-10-0074-01, 20-10-0076-01 and 20-10-0003-01.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca). For analytical information, or to enquire about the concepts, methods or data quality of this release, contact Jeff Paul (613-854-2518; jeff.paul@canada.ca), Mining, Manufacturing and Wholesale Trade Division.

- Date modified: