Consumer Price Index, November 2022

Released: 2022-12-21

November 2022

6.8%

(12-month change)

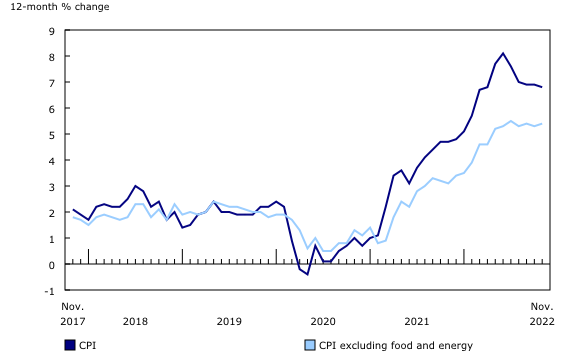

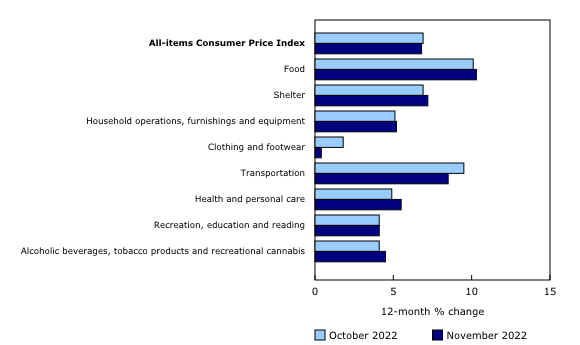

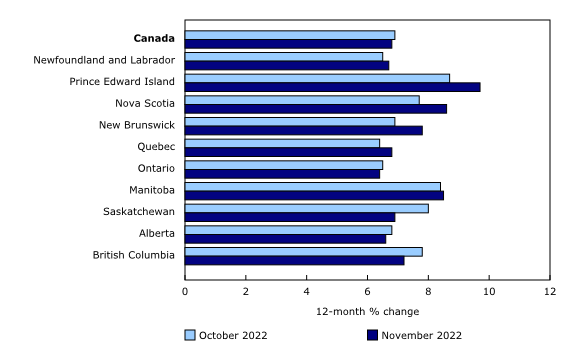

The Consumer Price Index (CPI) rose 6.8% year over year in November, following a 6.9% increase in October.

Excluding food and energy, prices rose 5.4% on a yearly basis in November, following a gain of 5.3% in October.

Slower price growth for gasoline and furniture was partially offset by faster growth in mortgage interest cost and rent.

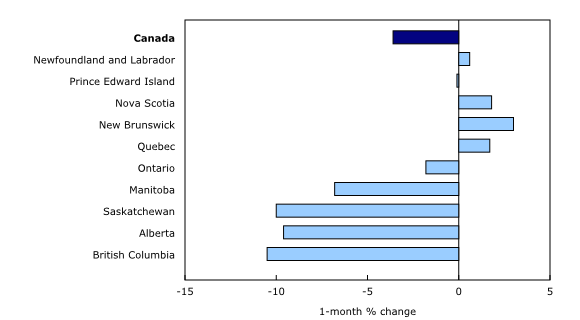

On a monthly basis, the CPI rose 0.1% in November following a 0.7% gain in October. On a seasonally adjusted monthly basis, the CPI was up 0.4%.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Gasoline prices fall month over month

On a monthly basis, gasoline prices fell 3.6% in November following a 9.2% increase in October, largely driven by price declines in Western Canada. The reopening of refineries in the western United States contributed to lower prices in British Columbia, Alberta, Saskatchewan and Manitoba.

Year over year, gasoline prices rose 13.7% in November after rising 17.8% in October.

Grocery prices increase at a slightly faster pace

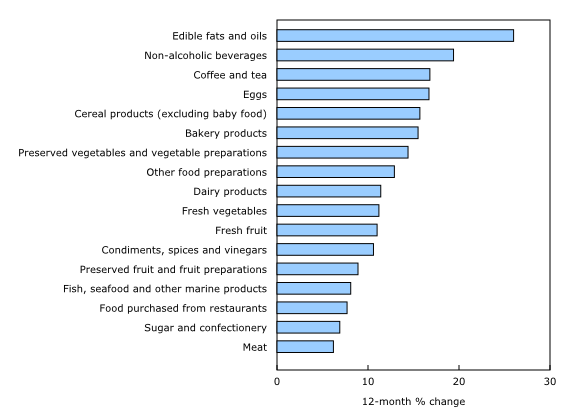

Prices for food purchased from stores rose 11.4% year over year in November, following an 11.0% gain in October. Food inflation remained broad-based, with prices for groceries rising at a faster rate than the all-items CPI every month since December 2021.

Canadians saw prices increase at a faster pace in November 2022 for non-alcoholic beverages (+19.4%), fresh fruit (+11.0%) and meat (+6.2%). Chicken prices rose 9.3% on a year-over-year basis, due partly to reduced global supply, as farmers have culled and quarantined birds infected with avian influenza.

Some notable year-over-year price increases were seen for products such as edible fats and oils (+26.0%), coffee and tea (+16.8%), eggs (+16.7%), cereal products (+15.7%) and bakery products (+15.5%). To explore some of the factors behind rising food prices, consult the article "Behind the Numbers: What's Causing Growth in Food Prices."

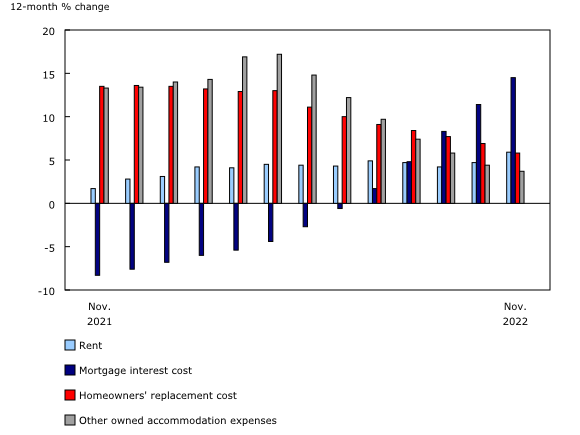

Shelter prices rise at a faster rate mainly due to mortgage interest cost and rent

Prices for shelter (+7.2%) rose at a faster pace year over year in November, mainly due to upward pressure from the mortgage interest cost and rent indexes.

Mortgage interest cost continued to rise at a faster rate year over year, up 14.5% in November compared with 11.4% in October, amid the higher interest rate environment. The increase in November was the largest since February 1983.

The rent index rose 5.9% in November on a year-over-year basis following a 4.7% increase in October. Among other factors, a higher interest rate environment, which may create barriers to homeownership, put upward pressure on the index. Rent prices accelerated the most in Prince Edward Island (+12.6%), British Columbia (+7.2%), Quebec (+5.3%) and Ontario (+7.1%).

Moderating the year-over-year price increase in the shelter component was a slowdown in the growth of the homeowners' replacement cost index (+5.8%) and other owned accommodation expenses (+3.7%), which includes realtor commission fees. These two indexes reflect a general cooling of the housing market, as growth in both indexes has slowed every month since May 2022.

Slower year-over-year growth in furniture prices

Furniture prices rose 8.1% year over year in November after eight consecutive months of increases above 12%. This was largely the result of a base-year effect resulting from a notable monthly price increase in November 2021 amid higher shipping costs. Supply chain constraints have eased throughout the second half of 2022, which may also have contributed to the deceleration of furniture prices in November.

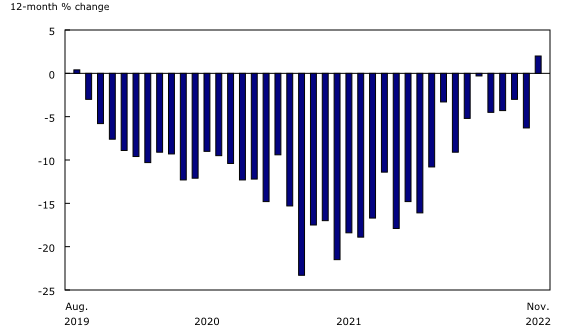

Prices for cellular services rise

In November, prices for cellular services rose on a year-over-year basis for the first time in three years. Consumers paid 2.0% more compared with November 2021, when prices fell amid a series of industry-wide price promotions offering reduced prices for phone plans and bonus data. Comparatively, there were fewer promotions offered in November 2022.

Regional highlights

Year over year, prices rose at a faster pace in November compared with October in six provinces. Faster price growth was most visible in Prince Edward Island (+9.7%), Nova Scotia (+8.6%) and New Brunswick (+7.8%), where consumers paid more for fuel oil and other fuels. Fuel oil is more commonly used in these provinces to heat homes.

Traveller accommodation in British Columbia

Year over year, consumers in British Columbia paid 9.5% more for traveller accommodation in November following a 32.7% increase in October. The slowdown, resulting from a 20.6% month-over-month decline, was driven by lower accommodation prices in Vancouver.

Electricity prices decelerate in Ontario

Electricity prices in Ontario rose at a slower year-over-year pace in November (+0.6%) compared with October (+3.7%), following a decrease in time-of-use rates, which was partially offset by a reduction in the Ontario electricity rebate.

Note to readers

Find the answers to the most common questions about the Consumer Price Index (CPI), including how food prices are collected, how shelter costs are measured, and why revisions to the CPI-common have been larger in recent months.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on January 3, 2023. For more information, consult the document "Real-time data tables."

Next release

The CPI for December 2022, including the Consumer Price Index Annual Review, will be released on January 17, 2023.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: