Annual Income Estimates for Census Families and Individuals (T1 Family File)

Family data - User guide

Statistics Canada

13C0016

Income Statistics Division

Statistics Canada

income@statcan.gc.ca

July 2014

Aussi disponible en français

Table of contents

- Introduction

- Section 1 — The data

- Data Source

- Data Currency

- Data Quality

- Confidentiality and Rounding

- Suppressed Data

- Low Income Measures

- Low Income Measures by Family Type

- Other Low Income Statistics

- Section 2 — The data tables

- Data Table Contents

- Statistical Tables – Footnotes and Historical Availability

- Section 3 — Glossary of terms

- Section 4 — Geography

- Geographic Levels - Postal Geography

- Adding postal areas without duplication

- City identification number (CityID)

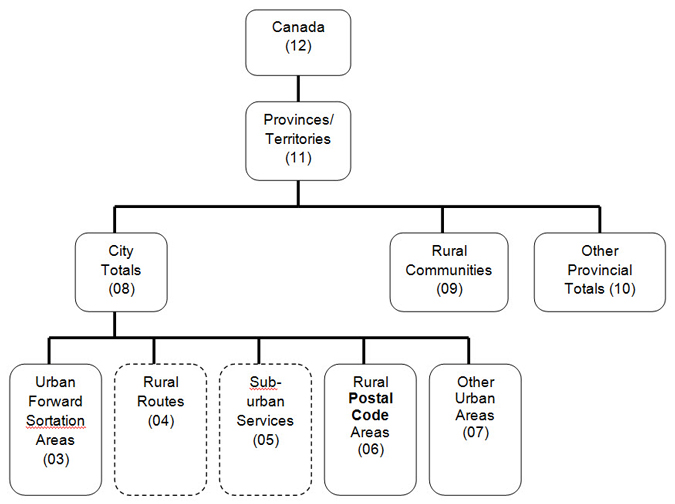

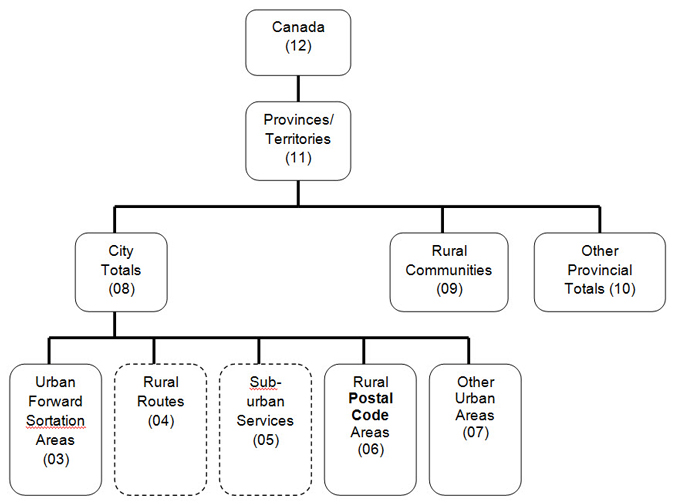

- Hierarchy of postal geography

- Geographic Levels - Census Geography

- Changes in Census Geography – 2011 boundaries as compared to 2006 boundaries

- Geographic Levels - Special Geography

- Postal Code Conversion File

- Geographic Levels - Postal Geography

- We invite your comments

- List of data products available

Introduction

Urban planning, social policy, and local marketing strategies require a comprehensive understanding of regional socio-economic characteristics. The T1 Family File (T1FF) data available for low levels of geography can contribute significantly to this knowledge.

The databank on census families is one of these T1FF data sources. This databank which currently includes 17 data tables is compiled from information obtained through annual personal income tax returns and is updated annually.

Starting with the 1994 tax year, two tables were added to the family series, bringing the total number of standard tables to 16.

Beginning with the 1995 data, a 17th table was added to the series; this table looks at low income among families, according to the Low Income Measure (LIM). Starting with the 1997 tax year, the databank featured a new (18th) table showing after-tax low income families, based onthe After-Tax Low Income Measure.

As of 2007, table 16 on family units and persons by language of tax form was terminated.

During the course of the years since 1990, minor changes have also been brought to various tables, depending on customer demands and on details available from the tax file. See total income in the Glossary section. Further changes to the standard tables are listed in the section “Statistical Tables - Footnotes and Historical Availability”.

Starting with 2010, the T1FF standard tables are available at no cost on CANSIM for the following geographies: Canada, provinces and territories, census metropolitan areas (CMA) and census agglomerations (CA starting with 2008). Data for other levels of geography can be obtained by contacting the Client Services Section of the Income Statistics Division, Statistics Canada (613-951-7355, toll free 1-888-297-7355, e-mail:income@statcan.gc.ca).

Note: For additional information on senior families, please refer to the T1FF Statistics Canada product 89C0022 – Seniors.

Section 1 - The data

Data Source

Development of Small Area and Administrative Data T1 Family File (T1FF) is based on the census family concept. This concept, specific to Statistics Canada, is similar to the traditional family concept. The census family data include parent(s) and children (i.e., children who do not live with their spouse or partner and do not have children of their own) living in the same dwelling.

Starting with the 1992 tax year, common-law couples were recognized as a separate category on the T1 General Tax form. As a result, the coverage of couple families (in which common-law families are included) is very high. Beginning with the 2000 data, same-sex couples reporting as a couple are included as common-law couples, and therefore counted in the couple category.

The initial population used to develop the family units comprises all taxfilers for the reference year and represents approximately two‑thirds of the Canadian population. The family units are formed from information obtained on the tax returns of the taxfiling family members.

First, taxfilers from the same family, including children, are matched using common links (e.g., spousal social insurance number, same name, and same address). Prior to 1993, non-filing children were identified from information on their parents’ tax form. Information from the Federal Family Allowance Program was used to assist in the identification of children. Since 1993, children are added to the family by using the Canada Child Tax Benefit (CCTB) file, the provincial births files and previous years of the T1FF.

The remaining taxfilers who have not been matched in the family formation process become persons not in census families (formerly non-family persons). They may be living with a family to whom they are related (e.g., brother-in-law, cousin, grandparent) or unrelated (e.g., lodger, roommate). They may be living with other persons not in census families or living alone.

The T1FF approximates the total Canadian population. It contains information on sources of income (from the taxfilers) and some demographic indicators (derived from both the taxfilers and the non‑filers).

For the most part, tax returns were filed in the spring of the year following the reference year. The mailing address at the time of filing is the basis for the geographic information in the tables.

Data Currency

Because the data are taken from tax records, they are current data from tax returns filed for the year noted on the tables. For example, 2012 income records are taken from 2012 tax returns filed in the spring of 2013, with data released during the summer of 2014. Data are released on an annual basis.

Data Quality

The data that appear in the tables are taken directly from the T1FF, built from the personal income tax and the Canada Child Tax Benefit (CCTB) records. Information on income is obtained from taxfilers and includes incomes of their non-filing spouses and children. Demographic information is derived from taxfilers and non-filing spouses and/or children, such as the estimates of "total taxfilers and dependents".

Most children do not file because they have low or no income. Improvements have been made to the process of identifying children. For example, the introduction of the Universal Child Care Benefit program in 2006 has allowed the identification of more children under the age of six. These changes have resulted in improved coverage of children in the T1FF data compared to the official Statistics Canada population estimates. The impact of these changes is most notable in the counts and median total income of lone-parent families although it is not possible to distinguish the precise impact of the improvements separately from normal year-to-year change.

Some elderly Canadians receiving only Old Age Security (OAS) pension and Guaranteed Income Supplement (GIS) do not file because they have low or no taxable income. However, with the introduction of the federal sales tax (FST) credit in 1986 and the goods and services tax (GST) credit in 1989, the percentage of the elderly population filing tax returns has increased. In 2012, 94.6% filed tax returns, up from 75% in 1989 (when comparing taxfilers aged 65 years or more with the 65 years or more population estimate counts to July 1, 2013, available from Statistics Canada’s CANSIM database, table 051-0001).The introduction of the FST and GST credits has also resulted in more low-income families filing tax returns.

Beginning in 1992, family total income was changed to include income of non-filing spouses reported on the taxfiler's income tax return. This caused an increase in family total income as well as an increase in median income for 1992. Starting with the 2001 data, wage and salary income of non-filing spouses can be identified, in some cases, from T4 earnings statements.

Comparing the tax-based family median income figures (T1FF) to the Statistics Canada Survey of Consumer Finances (SCF) shows the following results (Table A). The SCF was replaced by the Survey of Labour and Income Dynamics (SLID), and the definition of a family was changed for SLID.

| Year | Median Income, All Census families | % ratio | |

|---|---|---|---|

| T1FF | SCF/SLID | ||

| 1990 | 42,700 | 44,783 | 95.3% |

| 1991 | 42,900 | 45,368 | 94.6% |

| 1992 | 43,500 | 46,175 | 94.2% |

| 1993 | 43,000 | 45,583 | 94.3% |

| 1994 | 43,000 | 46,908 | 92.3% |

| 1995 | 44,200 | 47,124 | 93.8% |

| 1996 | 44,800 | 48,023 | 93.3% |

| 1997 | 45,900 | 48,862 | 93.9% |

| 1998 | 47,300 | 48,600 | 97.3% |

| 1999 | 48,600 | 50,900 | 95.5% |

| 2000 | 50,800 | 55,016 | 92.3% |

| 2001 | 53,500 | 55,100 | 97.1% |

| 2002 | 55,000 | 56,000 | 98.2% |

| 2003 | 56,000 | 57,800 | 96.9% |

| 2004 | 58,100 | 59,900 | 97.0% |

| 2005 | 60,600 | 63,866 | 97.4% |

| 2006 | 63,600 | 64,200 | 99.1% |

| 2007 | 66,550 | 67,100 | 99.2% |

| 2008 | 68,860 | 69,600 | 98.9% |

| 2009 | 68,410 | 69,200 | 98.9% |

| 2010 | 69,860 | 71,400 | 97.8% |

| 2011 | 72,240 | 74,700 | 96.7% |

| Note: The above T1FF medians are taken from the T1FF family databank being discussed here; the Survey of Consumer Finances (SCF) medians for 1990 to 1997 are from Statistics Canada's annual publication 13-208: Family Incomes, Census Families. The 2000 T1FF median is compared to the 2001 Census data (2000 income) and the 2005 T1FF median is compared to the 2006 Census data (2005 income).Starting from 1998 the Survey of Labour and Income Dynamics (SLID) median is taken from CANSIM table 202-0408. Because data in CANSIM for 202-0408 are presented in 2011 constant dollars, the series has been adjusted in current dollars using Consumer Price Indexes. The SCF and SLID estimates do not include the Territories. | |||

Confidentiality and Rounding

All data are subject to the confidentiality procedures of rounding and suppression.

To protect the confidentiality of Canadians, counts are rounded. Rounding may increase, decrease, or cause no change to counts. Rounding can affect the results obtained from calculations. For example, when calculating percentages from rounded data, results may be distorted as both the numerator and denominator have been rounded. The distortion can be greatest with small numbers.

All reported amounts are rounded to the nearest five thousand dollars.

Since 1990, data cells represent counts of 15 or greater, and are rounded to a base of 10. For example, a cell count of 15 would be rounded to 20 and a cell count of 24 would be rounded to 20.

For 1988 and 1989 data, all counts are 25 or greater and are rounded to the nearest 25. Reported amounts are rounded to the nearest thousand dollars.

For data up to and including 1987, all counts are randomly rounded to a base of 5, and reported amounts are unrounded, but are adjusted according to the rounding of the counts.

Note: Counts represent the number of persons. Reported amounts are aggregate dollar amounts reported.

Suppressed Data

To maintain confidentiality, data cells have been suppressed whenever:

- areas comprise less than 100 taxfilers;

- cells represent less than 15 taxfilers;

- cells were dominated by a single taxfiler;

- cells for median income were based on a rounded count of less than 20 taxfilers.

Suppressed data may occur:

1. Within one area:

- when one of the income categories is suppressed, a second category must also be suppressed to avoid disclosure of confidential data by subtraction (called residual disclosure) (Table B);

- when one of the gender categories is suppressed, the other gender category must also be suppressed to avoid residual disclosure (Table B);

- when one age group category is suppressed, another age group must also be suppressed to avoid residual disclosure.

2. Between areas:

- when a variable amount in one area is suppressed, that variable amount is also suppressed in another area to prevent disclosure by subtraction.

| Amount (Millions of Dollars) | |||

|---|---|---|---|

| Males | Females | Total | |

| Wages/Salaries/Commissions | 6.7 | 3.4 | 10.2 |

| Self-Employment | 0.3 | 0.2 | 0.5 |

| Dividends and Interest | 1.2 | 1.1 | 2.3 |

| Employment Insurance | 0.7 | 0.3 | 1 |

| Old Age Security/Net Federal Supplements | 0.7 | 0.5 | 1.1 |

| Canada/Quebec Pension Plan | 1.1 | 0.5 | 1.6 |

| Private Pensions | 1.9 | 0.4 | 2.3 |

| Canada Child Tax Benefits | Note x : Confidential when reported by fewer than 15 taxfilers. (In the data supplied to clients, the suppressed cell will contain a "0".) | Note x* : For the same income variable, the value for the opposite gender was suppressed in the table to avoid disclosure by subtraction. | 0.1 |

| Goods and Services Tax Credit/Harmonized Sales Tax Credit | Note x** : For the same income variable, the value for the opposite gender was suppressed in the table to avoid disclosure by subtraction. | Note x** : For the same income variable, the value for the opposite gender was suppressed in the table to avoid disclosure by subtraction. | 0.2 |

| Workers' Compensation | 0.1 | 0.1 | 0.2 |

| Social Assistance | 0.2 | 0.2 | 0.5 |

| Provincial Refundable Tax Credits | 0.1 | 0.1 | 0.2 |

| Registered Retirement Savings Plan Income | 0.1 | 0.1 | 0.2 |

| Other Income | 0.6 | 0.6 | 1.2 |

| Total Income | 14.5 | 7.8 | 22.3 |

| x Confidential when reported by fewer than 15 taxfilers. (In the data supplied to clients, the suppressed cell will contain a "0".) x* For the same income variable, the value for the opposite gender was suppressed in the table to avoid disclosure by subtraction. x** The value for a second income variable was suppressed elsewhere in the table to avoid disclosure by subtraction. |

|||

Low-Income Measures : Before-Tax and After-Tax

Low-Income Measures (LIMs) included in the T1FF family tables 17 and 18 (CANSIM 111-0015) are a relative measure of low income. LIMs are a fixed percentage (50%) of adjusted median family income where adjusted indicates a consideration of family needs. The family size adjustment used in calculating the LIMs reflects the precept that family needs increase with family size. A census family is considered to be low-income when their income is below the Low-Income Measure (LIM) for their family type and size.

The following steps outline the method to calculate the LIMs and to establish the low-income population for census families and persons not in census families. The procedure for the Before-Tax LIM and the After-Tax LIM is the same but a different income variable is incorporated into each of the calculations. Total Income is used for the Before-Tax LIM while Income After Tax is used for the After-Tax LIM. (See Section III Glossary for the definition of these variables.) For both of these measures, an adjustment is made for capital gains.

Here are the key components behind the calculation of the Low-Income Measure (LIM). This measure is calculated for the census family.

- Determine for each census family the adjusted family size whereby the first adult is counted as 1.0, each additional adult and each child 16 years of age and over as 0.4 and each child less that 16 years of age as 0.3 (except in a lone-parent family where the first child is counted as 0.4). Each person not in a census family is counted as 1.0.

- For each census family calculate an adjusted family income “by dividing their family income by their adjusted family size”. For persons not in census families, for whom the adjusted family size is 1.0, the adjusted family income is the individual’s income.

- Determine the median adjusted family income which is the adjusted family income where 50% of the families, including persons not in census families, have a smaller adjusted family income and 50% have a higher one.

- The LIM for a family of size one is 50% of the median adjusted family income and the LIMs for the other family types are equal to this value multiplied by their adjusted family size.

- Low-income census families and low-income persons not in census families are those whose incomes are below the LIM for their family types. Census families and persons not in census families whose incomes are equal to or above the LIM for their family type are not considered low income.

- This process is repeated for each year. Thus, the LIMs for each year are derived from the reported incomes of that year.

Low-Income Measures by Census Family Type

Tables C and D outline the before-tax and after-tax Low Income Measures (LIMs) for 2012. Both figures have the same format. Various census family types are outlined: lone-parent families (one adult with one, two and ten children), couple families (two adults with zero, one, two, and ten children), lone-parent or couple families with older children and younger children (one to four adults with zero, one, two and ten children) and persons not in census families (one adult, no children). Low-income census families and low-income persons not in census families are those whose (family) incomes are below the LIM for their family type.

| Number of AdultsNote * | Number of Children Less Than 16 Years of Age | ||||

|---|---|---|---|---|---|

| 0 | 1 | 2 | ..... | 10 | |

| 1 | 19,150 | 26,810 | 32,555 | ..... | 78,515 |

| 2 | 26,810 | 32,555 | 38,300 | ..... | 84,260 |

| 3 | 34,470 | 40,215 | 45,960 | ..... | 91,920 |

| 4 | 42,130 | 47,875 | 53,620 | ..... | 99,580 |

|

|||||

Example: The 2012 before-tax LIM for a person not in a census family is $19,150 and the 2012 before-tax LIM for a lone-parent family with two children 15 years of age and under is $32,555.

The before-tax LIM for any family size can be calculated by multiplying $19,150 by the appropriate adjusted family factor for a specific family size. For example, the before-tax LIM for a couple family with two children over the age of 15 is $42,130. This is calculated by multiplying $19,150 by 2.2.

| Number of AdultsNote * | Number of Children Less Than 16 Years of Age | ||||

|---|---|---|---|---|---|

| 0 | 1 | 2 | ..... | 10 | |

| 1 | 16,968 | 23,755 | 28,846 | ..... | 69,569 |

| 2 | 23,755 | 28,846 | 33,936 | ..... | 74,659 |

| 3 | 30,542 | 35,633 | 40,723 | ..... | 81,446 |

| 4 | 37,330 | 42,420 | 47,510 | ..... | 88,234 |

|

|||||

Example: The 2012 after-tax LIM for a person not in a census family is $16,968 and the 2012 after-tax LIM for a lone-parent family with two children 15 years of age and under is $28,846.

The after-tax LIM for any family size can be calculated by multiplying $16,968 by the appropriate adjusted family factor for a specific family size. For example, the after-tax LIM for a couple family with two children over the age of 15 is $37,330. This is calculated by multiplying $16,968 by 2.2.

Other Low-Income Statistics

In addition to the census family information produced from administrative files which is described in this user's guide, low-income statistics are also available for economic and census families from the Survey of Consumer Finances (up to 1997) and from the Survey of Labour and Income Dynamics (from 1993 onwards). These include Low Income Cut-Offs (LICOs), Market Basket Measures (MBMs) and Low-Income Measures (LIMs). For further information contact Client Services Section of the Income Statistics Division, Statistics Canada (613-951-7355, toll free 1-888-297-7355, e-mail:income@statcan.gc.ca).

Section 2 - The data tables

Data Table Contents

The following sections lists the T1FF standard family tables available for Canada, provinces and territories, federal electoral districts, economic regions, census divisions, census metropolitan areas, census agglomerations, and census tracts. In some cases tables retrieved in an Excel have been divided in parts for display purposes. The T1FF standard tables are available at no cost on CANSIM for the following geographies: Canada, provinces and territories, census metropolitan areas and census agglomerations (CA starting as of 2008).

Table 1: Summary table

CANSIM Table 111-0009 Family characteristics, summary

- Count of taxfilers

- Count of taxfilers and dependents by age group: under 15, 15-64, 65 and over, total

- Count of all census families (couple families + lone-parent families) and the number of persons in census families; similar counts are also given for couple families, lone-parent families and persons not in census families

- Median family total income and median individual total income for all census families, for couple families, for lone-parent families and for persons not in census families

- Count of all census families with employment income, of persons not in census families with employment income, and their median employment income

- Count of dual-earner couple families, of single-earner-male families, of single-earner-female families, and the median employment income of these families

- Count of all census families and of persons not in census families receiving transfer payments, and the median amount of transfer payments

- Count of census families with at least one member with labour income; the number of census families receiving Employment Insurance (EI) benefits and the median amount received; count of persons not in census families with labour income, the number receiving EI benefits and the median amount received

Table 2: Persons by age group and by census family type

CANSIM Table 111-0010 Family characteristics, by family type and age group

- Count of parents and children in couple families, by age group

- Count of parents and children in lone-parent families, by age group

- Count of persons not in census families by age group

- Count and percentage of taxfilers and dependents by age group

- Average age of taxfilers and dependents

Table 3: Census families by age of older partner/parent and by number of children

CANSIM Table 111-0011 Families by type, composition and parent characteristics

The non CANSIM version of this table is in 3 parts.

Table 3a:

- Count of couple families by age of older partner/parent and by number of children

- Average family size for all couple families and for couple families with children

- Median total income of couple families by number of children, of all couple families and of couple families with children

Table 3b:

- Count of lone-parent families by age of parent and by number of children

- Count of male and of female (and total) lone-parent families by age of parent

- Average family size of lone-parent families by age of parent

- Median total income of lone-parent families by number of children and by gender of parent

Table 3c:

- Count of all census families by number of children and by age of (older) partner/parent

- Average family size of all census families and of census families with children, by age of (older) partner/parent

- Median total income of all census families by number of children, of all census families and of census families with children

Table 4: Distribution of total income by census family type and age

CANSIM Table 111-0012 Family characteristics, by income group and age of older adult

The non CANSIM version of this table is in 3 parts.

Table 4a:

- Count of couple families by age of older partner and by cumulative total family income group; median family total income by age group of older partner

Table 4b:

- Count of lone-parent families by age of parent and by cumulative total family income group; median family total income by age group of parent

Table 4c:

- Count of persons not in census families by age and by cumulative total income group; median total income by age group

Table 5: Census families by total income and by number of children

CANSIM Table 111-0013 Families by family type, composition and total income

The non CANSIM version of this table is in 2 parts.

Table 5a:

- Count of couple families by number of children and by cumulative total family income group, showing the median total family income by number of children

Table 5b:

- Count of lone-parent families by number of children and by cumulative total family income group, showing the median total family income by number of children

Table 6: Sources of income by census family type

CANSIM Table 111-0014 Sources of income by family type

- Sources of income (number reporting and amount reported) for couple families, lone-parent families, persons not in census families and total for all census families and persons not in census families. The income sources are:

- Employment income (total)

- Wages, salaries and commissions

- Self-employment income

- Farm + fish self-employment income

- Other self-employment income

- Investment income

- Government transfers

- Employment Insurance (EI)

- Old Age Security (OAS) pension benefits/net federal supplements

- Canada/Quebec Pension Plan (CPP/QPP) benefits

- Canada Child Tax Benefits (CCTB)

- Goods and services tax (GST) credit/harmonized sales tax (HST) credit

- Workers' Compensation

- Social Assistance

- Provincial refundable tax credits/family benefits

- Other Government Transfers

- Private pensions

- RRSP income

- Other income

- Total income

Table 7: Economic dependency profile of couple families

CANSIM Table 111-0016 Economic dependency profile, by family type and source of income

- For all couple families, for male partners, for female partners, for children and for the entire population: the number reporting employment income and the value reported, the number reporting transfer payments and the median value reported. These transfer payments include:

- All government transfers

- Employment Insurance (EI)

- Goods and services tax (GST) credit/harmonized sales tax (HST) credit

- Canada Child Tax Benefits (CCTB)

- Old Age Security (OAS) pension benefits/net federal supplements

- Canada/Quebec Pension Plan (CPP/QPP) benefits

- Workers' Compensation

- Social Assistance

- Provincial refundable tax credits/family benefits

- Other Government Transfers

- Private pensions (up to the year 2006)

Table 8: Economic dependency profile of lone-parent families and persons not in census families

CANSIM Table 111-0016 Economic dependency profile, by family type and source of income

- For all lone-parent families, for parents, for children, for persons not in census families and for the entire population: the number reporting employment income and the value reported, the number reporting transfer payments and the median value reported. These transfer payments include:

- All government transfers

- Employment Insurance (EI)

- Goods and services tax (GST) credit/harmonized sales tax (HST) credit

- Canada Child Tax Benefits (CCTB)

- Old Age Security (OAS) pension benefits/net federal supplements

- Canada/Quebec Pension Plan (CPP/QPP) benefits

- Workers' Compensation

- Social Assistance

- Provincial refundable tax credits/Family benefits

- Other Government Transfers

- Private pensions (up to the year 2006)

Table 9: Labour income profile of couple families

CANSIM Table 111-0017 Family characteristics, labour income profile by family type

- Count of couple families, of males partners, of female partners and of children in couple families, and of the entire population

- For couple families, for male partners, for female partners and for children in couple families and for the entire population: counts of numbers reporting labour income and the value reported. The different incomes shown are:

- Total income

- Labour income

- Employment income

- Wages/salaries/commissions

- Self-employment income

- Employment Insurance (EI)

- Employment income

Table 10: Labour income profile of lone-parent families and persons not in census families

CANSIM Table 111-0017 Family characteristics, labour income profile by family type

- Count of lone-parent families, of parents and of children, of persons not in census families and of the entire population

- For lone-parent families, for parents and for children in lone-parent families, for persons not in a census family and for the entire population: counts of numbers reporting labour income and the value reported. The different incomes shown are:

- Total income

- Labour income

- Employment income

- Wages/salaries/commissions

- Self-employment income

- Employment Insurance

- Employment income

Table 11: Labour income by age group and gender

CANSIM Table 111-0018 Labour characteristics, by sex and age group

- Count of taxfilers and dependents by age group and by gender

- Count of taxfilers and dependents with labour income by age group and by gender

- Participation rates by age group and by gender

Table 12: Employment insurance by age group and gender

CANSIM Table 111-0019 Persons receiving Employment Insurance by sex and age group

- Count of taxfilers and dependents with labour income by age group and by gender

- Count of Employment Insurance recipients by age group and by gender

Table 13: Single-earner and dual-earner census families by number of children (Includes only partners/parents reporting non-negative employment income)

CANSIM Table 111-0020 Single-earner and dual-earner families, by number of children

- Number reporting, total employment income of parent/partners reported and the median employment income of parent/partners for:

- Male single-earner couple families by number of children

- Female single-earner couple families by number of children

- Dual-earner couple families by number of children

- Lone-parent families by number of children

Note:Excluded from this table are census families where a spouse (either one in couple families, or the sole parent in lone-parent families) reported negative employment income, and census families where both spouses (in couple families, or the sole parent in lone-parent families) reported no employment income.

Table 14: Husband-wife families by percentage of wife's contribution to husband-wife employment income (Includes only spouses reporting non-negative employment income)

CANSIM Table 111-0021 Husband-wife families, by wife’s contribution to husband-wife employment

The non CANSIM version of this table is in 3 parts.

Table 14a:

- Counts of husband-wife families by number of children and by percentage of wife's contribution to the husband-wife employment income

Table 14b:

- Counts of husband-wife families by age of wife and by percentage of wife's contribution to the husband-wife employment income

Table 14c:

- Counts of husband-wife families by family employment income range and by percentage of wife's contribution to the husband-wife employment income

Note: Excluded from this table are:

- same-sex couples,

- families where a spouse (either one) reported negative employment income, and

- families where both spouses reported no employment income.

Table 15: Census family units and children by age of children

CANSIM Table 111-0022 Family characteristics, families with children by age of child

- Counts of census families (couple, lone-parent and total for all census families) by age of children

- Counts of children in census families (couple, lone-parent and total for all census families) by age of children

- The age groups used are:

- All children under 6 years

- All 6-14

- All 15-17

- Some under 6 and some 6-14

- Some under 6 and some 15-17

- Some 6-14 and some 15-17

- Some under 6, some 6-4 and some 15-17

- All under 18

- Some under 18 and some 18 and over

- All 18 and over

Table 17: Before-tax low income (based on before-tax low-income measures, LIMs)

CANSIM Table 111-0015 Low Income Measures, by family type (combines table 17 and 18)

For all couple families, all lone-parent families, all persons not in census families and a total of these three groups, the table contains the following information:

- Count of census families or persons not in census families by number of children and total

- Median before-tax family income by number of children and a total

- Number of persons within a census family by number of children and a total

- Number of children 0 to 17 years of age by number of children within a census family and total

- Number of persons 65 years of age and over by number of children within a census family and total

For low-income couple families, low-income lone-parent families, low-income persons not in census families and a total of these three groups, the same information as outlined above is available:

- Count of census families or persons not in census families by number of children and total

- Median before-tax family income by number of children and a total

- Number of persons within a census family by number of children and a total

- Number of children 0 to 17 years of age by number of children within a census family and total

- Number of persons 65 years of age and over by number of children within a census family and total

Table 18: After-tax low income (based on after-tax low-income measures, LIMs)

CANSIM Table 111-0015 Low Income Measures, by family type (combines table 17 and 18)

For all couple families, all lone-parent families, all persons not in census families and a total of these three groups, the table contains the following information:

- Count of census families or persons not in census families by number of children and total

- Median after-tax family income by number of children and a total

- Number of persons within a census family by number of children and a total

- Number of children 0 to 17 years of age by number of children within a census family and total

- Number of persons 65 years of age and over by number of children within a census family and total

For low-income couple families, low-income lone-parent families, low-income persons not in census families and a total of these three groups, the same information as outlined above is available:

- Count of census families or persons not in census families by number of children and total

- Median after-tax family income by number of children and a total

- Number of persons within a census family by number of children and a total

- Number of children 0 to 17 years of age by number of children within a census family and total

- Number of persons 65 years of age and over by number of children within a census family and total

Statistical tables – Footnotes and historical availability

Note: for changes to variable definitions, please see Glossary of Terms.

All tables:

- Because they are based on a different methodology, estimates of the number of Census families presented in these tables differ from estimates produced by Demography Division.

- The income shown here could be reported by any member of the census family.

- Income ranges are cumulative and not discrete (since 1993). This means that a person with an income of $100,000 will be included in the $10,000+ category, in the $15,000+ category, in the $20,000+ category, in the $25,000+ category, etc.

- Starting with 2000 data, same-sex couples are counted as couple families (formerly “husband-wife families”).

- Available for Canada, the provinces and the territories and for census divisions and for census metropolitan areas.

- Available for census tracts, economic regions and federal electoral districts starting with 1999 data.

- Available for census agglomerations starting with 2001 data.

- Working Income Tax Benefit is included in Government Transfers and Total Income starting with 2010 data.

Table 1:

- Available since 1990.

- Number of taxfilers added in 1993.

- For All Families, Couple Families, Lone-Parent Families and Non-Family Persons, Per Capita Income was replaced by Person Median Income starting with 2007 data.

- For All Families (Couple and Lone-Parent) and Non-Family Persons, Government Transfers Average Amount was replaced by Government Transfers Median Amount starting with 2007 data.

- For Number of Families (Couple and Lone-Parent) and Non-Family Persons, Employment Insurance Benefits Average Amount was replaced by Employment Insurance Benefits Median Amount starting with 2007 data.

Table 2:

- Available since 1990.

- Average age was added to this table starting with 1994.

Table 3:

- Available in its current format since 1990.

Table 4:

- Available since 1990.

- Income groups were changed from discrete to cumulative groups starting with 1993.

- Income groups were added in 1993 (up to $250,000 for couple families and $100,000 for lone-parent families and persons not in census families).

- In 1995, group $55,000+ was removed from couple families table and $75,000 was added.

Table 5:

- Available since 1990.

- Income groups were changed from discrete to cumulative groups starting with 1993.

- Income groups were added in 1993 (up to $250,000 for couple families and $100,000 for lone-parent families and persons not in census families).

- In 1995, group $55,000+ was removed from couple families table and $75,000 was added.

Table 6:

- Available since 1990.

- The sources of income have changed over the years, depending on the information available from the T1.

- For 1990-1995, transfer payments included government transfers and private (other) pensions; starting with 1996, private pensions are shown separately from government transfers. In 2010, Working Income Tax Benefit (WITB) is shown as Other Government Transfers and included in government transfers.

- Information on workers’ compensation and social assistance available as separate income sources since 1994 (previously included in "non-taxable income").

- Information on RRSP income available since 1994 (previously included in "other income").

- Total = couple families + lone-parent families + persons not in census families.

Tables 7 and 8:

- Available since 1990.

- For 1990-1995, transfer payments included government transfers and other (private) pensions; starting with 1996, private pensions are shown separately from government transfers. In 2010, Working Income Tax Benefit (WITB) is shown as Other Government Transfers and included in government transfers.

- Information on workers’ compensation and social assistance available as separate income sources since 1994 (previously included in "non-taxable income").

- For Couple Families, Male Partners, Female Partners, Children, and Taxfilers and dependents, Government Transfers Average Amount was replaced by Government Transfers Median Amount starting with 2007 data.

- Private Pensions (Number, Amount and Economic Dependency) have been removed in 2007.

Tables 9 and 10:

- Available since 1990.

- Since 1992, total population count includes taxfilers and dependents

- Employment Insurance (previously unemployment insurance) rate shown only for 1990 and 1991.

- Information on wages, salaries and commissions added in 1993 (counts and amounts).

- Change to table layout in 1999 (“self-employment” category now follows “wages, salaries and commissions”).

Table 11:

- Available in its current format since 1990.

- The gender of the non-filing children is, in many cases, not known to us; for this reason, the number of all persons or taxfilers and dependents in the male and female columns does not add to the figure in the total column for the 15-19 age group.

- The participation rate is calculated by dividing the number of persons with labour income by the total number of persons and multiplying by 100. Rate is not shown for the 15-19 age group since 1997.

Table 12:

- Available since 1990.

- "Total population" replaced with "Labour Income" with the 1992 data

- Employment Insurance (previously Unemployment Insurance) rate shown only for 1990 and 1991

Table 13:

- Available since 1990.

- Not included in this table are 1) census families where either partner or lone-parent reported negative employment income, and 2) census families where neither partner or lone-parent reported employment income.

- “Average contribution of wife” removed starting with 2001 data.

Table 14:

- Available since 1990.

- Not included in this table are 1) same-sex couples, 2) husband-wife families where either spouse reported negative employment income, and 3) husband-wife families where neither spouse reported employment income.

- Only husband-wife families with an employment income greater than zero are considered here.

- 0% represents contributions equal to or less than 0.5% and 100% represents contributions equal to or greater than 99.5%.

- Since 1991, family totals are shown in each table section.

- Average contribution of wife added starting with 2001 data.

- Average contribution of wife was replaced by Median contribution of wife starting with 2007 data.

Table 15:

- Available in its current format since 1993.

Table 16:

- Available in its current format since 1993.

- The total column on the far right of the printed page represents couple families + lone-parent families + persons not in census families.

- Terminated in 2007.

Table 17:

- Available in its current format since 1995.

- Available for census tracts, federal electoral districts and economic regions starting with 2000 data.

Table 18:

- Available in its current format since 1997.

- Available for census tracts, federal electoral districts and economic regions starting with 2000 data.

Section 3 — Glossary of terms

Age

Is calculated as of December 31 of the reference year (i.e., tax year minus year of birth). Starting in 2007, all the counts are rounded to the nearest 10.

Alberta Family Employment Tax Credit

Beginning in 1997, the Alberta Family Employment Tax Credit is a non-taxable amount paid to families with working income that have children under the age of 18. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Alberta Resource Rebate

Is a one-time payment of $400 made in 2006 to residents of Alberta who filed an income tax return and who were 18 years and over. Rebate for children who are under 18 will be paid to their primary caregiver. Included in Provincial refundable tax credits/Family benefits in the statistical tables for 2006 only.

Alimony

Includes payments from one former spouse to the other, for couples that are separated or divorced. Child support is also included in this variable, as reported on line 128 of the T1 tax form, where both alimony and child support are reported together, without distinction. Starting with 1998, this information is taken from line 156 of the T1 (support payments received). Included in “Other income” in the statistical tables.

All (Census) Families

Include couple families and lone-parent families.

Average Family Size

Is the average count of persons in the census family.

British Columbia Climate Action Dividend

It is a one-time payment of $100 made in 2008 to all residents of British Columbia. The British Columbia Climate Action Dividend (BCCAD) is a payment intended to help British Columbians make changes to reduce their use of fossil fuels. The Canada Revenue Agency is administering this program on behalf of British Columbia. Included in Provincial refundable tax credits/Family benefits in the statistical tables for 2008 only.

British Columbia Earned Income Benefit

Beginning in 1996, families whose annual earned income is more than $3,750 may also be entitled to the B.C. earned income benefit. The maximum monthly benefit is dependent on the number of eligible children and the family’s net income

British Columbia Family Bonus

Commencing in July 1996, the BC Family Bonus program provides non-taxable amounts paid monthly to help low- and modest-income families with the cost of raising children under the age of 18. This program includes the basic Family Bonus and the BC Earned Income Benefit. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

British Columbia Harmonized Sales Tax Credit

Introduced in 2010, this credit is a non-taxable refundable payment to help low-income individuals and families offset the impact of the sales taxes they pay. It replaced the British Columbia Sales Tax Credit.

British Columbia Low Income Climate Action Tax Credit

Beginning in 2008, the province of British Columbia introduced the British Columbia Low Income Climate Action Tax Credit. This credit is intended to help low income individuals and families with the carbon taxes they pay and is part of the province’s commitment that the carbon tax be revenue neutral. The Canada Revenue Agency will administer this program on behalf of British Columbia. This credit is an ongoing non-taxable quarterly payment. Included in Goods and services tax/harmonized sales tax (GST/HST) credit in the statistical tables.

British Columbia Sales Tax Credit

From 1994 to 2009, the British Columbia Sales Tax Credit was provided to low-income families and individuals.

British Columbia Seniors Home Renovation Tax Credit

Introduced in 2012, the B.C. seniors home renovation tax credit assists individuals 65 and over with the cost of certain permanent home renovations to improve accessibility or help a senior be more functional or mobile at home.

British Columbia Seniors Supplement

Beginning in 2005, the province of British Columbia introduced a monthly payment to seniors receiving federal Old Age Security (OAS) and the Guaranteed Income Supplement (GIS).

Canada Child Tax Benefit (CCTB)

Is a system that replaces (beginning with the 1993 data year) the previous federal Family Allowance program, the non-refundable child deduction and the refundable Child Tax Credit. It is an income supplement for individuals who have at least one qualified dependent child. The Canada Child Tax Benefit is also based on the individual's family income and the number of dependent children. The Universal Child Care Benefit is added to the CCTB beginning with the 2006 data in the statistical tables.

Canada/Quebec Pension Plan (CPP/QPP)

Are compulsory contributory social insurance plans that protect workers and their families against loss of income due to retirement, disability or death. Canada Pension Plan and Quebec Pension Plan benefits include all benefits reported for the reference year.

Census Family

This definition of the census family classifies people in the following manner: 1) couples (married or common-law) living in the same dwelling, with or without children; and 2) lone-parents (male or female) with one or more children. The residual population is called "persons not in census families" and is made up of persons living alone and of persons living in a household but who are not part of a couple family or lone-parent family. See also “Children”.

Children

Are taxfilers or imputed persons in couple and lone-parent families. Taxfiling children do not live with their spouse, have no children of their own and live with their parent or parents. Previous to the 1998 data, taxfiling children had to report “single” as their marital status. Most children are identified from the Canada Child Tax Benefit file, a provincial births file or a previous T1 family file.

CityID

Since names can be, in some cases, quite long and cumbersome for handling in electronic files, municipalities are given a city identification number. Starting in 2007, the CityID is a five digits alpha-numeric component. It is created with the first letter of Postal Code followed by “9” and a four digits number. Each first letter of Postal Code is allocated a range of number from 1 to 9999 (more explanation in geography section).

Couple Family

Previously Husband-Wife Family

Consists of a couple living together (whether married or common-law) at the same address, and any children living at the same address; taxfiling children do not live with their spouse, have no child of their own and live with their parent or parents. Previous to the 1998 data, taxfiling children had to report “single” as their marital status. Beginning in 2000, same-sex couples reporting as couples are counted as couple families. See also Census families.

Dependents

For the purpose of these databanks, dependents are the non-filing members of a family. We do not attempt to measure dependency in any way, but are able to identify certain non-filing family members, and include these in the total counts of people in a given area.

Dividend Income

Includes dividend income from taxable Canadian corporations (such as stocks or mutual funds) as reported on line 120 of the personal income tax return, and then grossed down to the actual amounts received; dividend income does not include dividends received from foreign investments (which are included in interest income and reported on line 121).

Dual-Earner Families

Are couple families where both spouses have an employment income greater than zero.

Economic Dependency Ratio (EDR)

Is the sum of transfer payment dollars received as benefits in a given area, compared to every $100 of employment income for that same area. For example, where a table shows an Employment Insurance (EI) dependency ratio of 4.69, it means that $4.69 in EI benefits were received for every $100 of employment income for the area.

Employment Income

Includes wages and salaries, commissions from employment, training allowances, tips and gratuities, self-employment income (net income from business, profession, farming, fishing and commissions) and Indian Employment Income (since 1999).

Employment Insurance (EI) Previously Unemployment Insurance (UI)

Comprises all types of benefits paid to individuals under this program, regardless of reason, including regular benefits for unemployment, fishing, job creation, maternity, parental/adoption, retirement, self-employment, sickness, training and work sharing.

Families Reporting Income

Families are counted for a given source of income when that income is received by at least one family member. Families and individuals may report more than one source of income.

Family Benefits

See Alberta Family Employment Tax Credit; British Columbia Family Bonus; Canada Child Tax Benefit; New Brunswick Child Tax Benefit Supplement; Newfoundland and Labrador Child Benefit; Northwest Territories Child Benefit; Nova Scotia Child Tax Benefit; Nunavut Child Benefit; Ontario Child Care Supplement for Working Families; Manitoba Child Tax Benefit; Quebec Child Assistance Payment; Yukon Child Benefit.

Family Total Income

Is the sum of the total incomes of all members of the family (see "Total income”). New to the 1992 definition of total income is income for non-filing spouses. The information is derived from the taxfiling spouse.

Family with labour income

Includes all families where at least one of its members has reported employment income (wages, salaries, commissions or self-employment) or employment insurance benefits in the reference year.

Goods and Services Tax (GST) Credit

Includes all amounts received through this program. In 1990, the goods and services tax credit began replacing the federal sales tax (FST) credit. By 1991, the FST credit no longer existed. Beginning in 1997, the GST was harmonized with the provincial sales taxes for certain provinces.

Government Transfer Payments

For the purpose of these data, transfer payments denote the following payments made to individuals by the federal or provincial governments:

- Unemployment Insurance/ Employment Insurance since 1982;

- Federal Sales Tax Credit (from 1988 to 1990);

- Goods and Services Tax (GST) credit (which began replacing the FST credit in 1990 and completely replaced it by 1991, and became the GST/HST credit starting in 1997);

- Family Allowance program up to 1992;

- Child Tax Credit (to 1992);

- Canada Child Tax Benefit (starting with 1993);

- Universal Child Care Benefit since 2006;

- Old Age Security since 1982;

- Net Federal Supplements (includes Guaranteed Income Supplement) since 1992;

- Canada and Quebec Pension plans benefits, non-taxable income and provincial refundable tax credits (both beginning in 1990), since 1982;

- Working Income Tax Benefit (starting in 2007 depending on the province or territory; included since 2010 in the statistical tables);

- Provincial Refundable Tax Credits/Family Benefits – for a complete list please see the “Provincial Refundable Tax Credits/Family Benefits” section.

The individuals in this case receive these payments without providing goods or services in return. Previous to the 1996 data, Transfer payments also included superannuation and other (private) pensions.

Harmonized Sales Tax (HST)

In Newfoundland and Labrador, Nova Scotia and New Brunswick, the provincial sales tax has been harmonized with the goods and services tax (GST) since 1997, to become the harmonized sales tax. Ontario and British Columbia harmonized their provincial sales tax starting in 2010. For this reason, the federal GST credit is now known as the GST/HST credit.

Husband-Wife Family

Similar to the Couple family concept but excludes same-sex couples. For more information,see Couple family.

Imputed Persons

Are persons who are not taxfilers, but are reported or otherwise identified by a taxfiler (for example, a non-filing spouse or child).

Income After Tax

Is total income minus provincial and federal income taxes plus Quebec Abatement.

Index

Is a comparison of the variable for the given area with either the province (province = 100) or with Canada (Canada = 100).

Interest Income

Refers to the amount Canadians claimed on line 121 of the personal income tax return. This amount includes interest generated from bank deposits, Canada Savings Bonds, corporate bonds, treasury bills, investment certificates, term deposits, annuities, mutual funds, earnings on life insurance policies and all foreign interest and foreign dividend incomes.

Investment Income

Includes both interest income and dividend income.

Labour Income

Includes income from employment and Employment Insurance benefits.

Level of Geography

Is a code designating the type of geographic area to which the information in the table applies. See the section onGeography for further information.

Limited Partnership Income

Is net income (i.e., gross income less expenses) from a limited partnership, where a limited partner is a passive or non-active partner whose liability as a member is limited to his or her investment. Included in "Other income" in the statistical tables.

Lone-Parent Family

Is a family with only one parent, male or female, and with at least one child. See also"Census families" and “Children”.

Low-Income Measure (LIM)

The Low-Income Measure is a relative measure of low income. LIMs are a fixed percentage (50%) of adjusted median family income where adjusted indicates a consideration of family needs. The family size adjustment used in calculating the Low-Income Measures reflects the precept that family needs increase with family size. For the LIM, each additional adult, first child (regardless of age) in a lone-parent family, or

child over 15 years of age, is assumed to increase the family’s needs by 40% of the needs of the first adult. Each child less than 16 years of age (other than the first child in a lone-parent family), is assumed to increase the family’s needs by 30% of the first adult. A family is considered to be low income when their income is below the Low-Income Measure (LIM) for their family type and size.

Manitoba 55 Plus Program

Included in 2012, the 55 PLUS Program provides quarterly benefits to lower-income Manitobans who are 55 years of age and over.

Manitoba Advanced Tuition Tax Rebate

Introduced in 2010 by the Province of Manitoba to assist post-secondary students claim an advanced credit against tuition fees payable for the school year up to November of the current tax year. Included in Provincial refundable tax credits/Family benefits in the statistical table

Manitoba Child Tax Benefit

Beginning in 2008, the Manitoba Child Benefit (MCB) is a provincial supplement program that replaces and enhances the Child Related Income Support Program. The MCB provides monthly benefits to low-income Manitoba families needing assistance with the cost of raising children. The MCB is part of Manitoba’s Rewarding Work strategy to help Manitobans move from income assistance to work. Under the MCB, maximum monthly benefits are available to families at higher income levels, and assets are no longer considered when calculating eligibility benefits. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Manitoba Education Property Tax Credit

Instituted in 2001 by the Province of Manitoba to assist all residents to offset some or all school tax component paid along with their property taxes. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Manitoba School Tax Credit For Homeowners

Introduced in 2001 by the Province of Manitoba to assist homeowners 55 years of age to receive an additional tax credit against property taxes paid. Included in Provincial refundable tax credits/Family benefits in the statistical table

Median

Is the middle number in a group of numbers. Where a median income, for example, is given as $26,000, it means that exactly half of the incomes reported are greater than or equal to $26,000, and that the other half are less than or equal to the median amount. Median incomes in the data tables are rounded to the nearest hundred dollars and starting with 2007 to the nearest ten dollars. Zero values are not included in the calculation of medians for individuals, but are included in the calculation of medians for families.

Negative Income

Generally applies to net self-employment income, net rental income and net limited partnership income. Negative income would indicate that expenses exceeded gross income.

Net Federal Supplements

Are part of the Old Age Security (OAS) pension program, intended to supplement the income of pensioners and spouses with lower income; payments take the form of a Guaranteed Income Supplement (GIS) or a Spouse's Allowance (SPA). Between 1990 and 1993, net federal supplements were included in “non-taxable income”.

Net Rental Income

Is income received or earned from the rental of property, less related costs and expenses. Included in “Other income”.

New Brunswick Child Tax Benefit

Since 1997, the New Brunswick Child Tax Benefit (NBCTB) is a non-taxable amount paid monthly to qualifying families with children under the age of 18. The New Brunswick Working Income Supplement (NBWIS) is an additional benefit paid to qualifying families with earned income who have children under the age of 18. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

New Brunswick Home Energy Assistance Program

Is a one-time payment of $100 made in 2007 to residents of New Brunswick to help low-income families cope with high electricity and energy prices. Included in Provincial refundable tax credits/Family benefits in the statistical tables of 2007 only.

New Brunswick Low Income Seniors Benefit

Included in 2005, this credit is a refundable credit available to assist low-income seniors in New Brunswick. The government offers a $400.00 annual benefit to qualifying applicants.

Newfoundland and Labrador Child Benefit

Beginning in 1999, the Newfoundland and Labrador Child Benefit (NLCB) is a non-taxable amount paid monthly to help low-income families with the cost of raising children under the age of 18. The Mother Baby Nutrition Supplement (MBNS) is an additional benefit paid to qualifying families who have children under the age of one. In addition, The Mother Child Benefit Supplement (MCBS) is a one-time payment made at the time of birth for each child. In 2008 the Newfoundland and Labrador introduced two additional parental benefits known as Progressive Family Growth Benefit (PFGB) and the Parental Support Benefit (PSB). Starting in 2011, there is a new, non refundable, Child Care Credit amount equal to child care expenses currently deductible from income. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables

Newfoundland & Labrador Harmonized Sales Tax Credit

Newfoundland and Labrador has chosen to introduce a supplementary provincial HST credit for its residents. Residence and amount apart, eligibility for the Newfoundland and Labrador credit is identical to federal GST credit requirements, and application for the Newfoundland and Labrador HST credit is automatic if one applies for federal GST credit and is resident in Newfoundland and Labrador; the federal government will calculate the Newfoundland and Labrador credit (if any) and pay it in due course. This credit has been included in the statistical tables since 2005.

Newfoundland and Labrador Home Heating Rebate

Beginning in 2007, the Newfoundland and Labrador Home Heating Rebate is an amount available to individuals and families with a household income of $30,000 or less regardless of whether they heat their homes by home heating fuel, electricity or wood. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Newfoundland and Labrador Mother Baby Nutrition Supplement

This refundable tax credit is intended to help low income pregnant mothers and families with children under the age of one with the cost of extra food during pregnancy and infancy. It is a monthly financial benefit which was introduced in 2002. The applicant must be a permanent resident of Newfoundland and Labrador.

Newfoundland and Labrador Mother Child supplement

Since 2007, and in addition to those who are eligible for the Mother Baby Nutrition Supplement, mothers of newborn babies are receiving a refundable tax credit of $90 at the time of the birth of their child.

Newfoundland and Labrador Parental Support BenefiT (PSB)

Is a monthly benefit available to residents of the province of Newfoundland and Labrador for the 12 months after the child’s birth or the 12 months after the adopted child is place in the home on or after January 1st 2008.

Newfoundland and Labrador Progressive Family Growth Benefit

Starting in 2008, the Progressive Family Growth Benefit is a refundable tax credit that provides a $1,000 lump sum payment to residents of the province who give birth to a baby or have a child placed with them for adoption.

Newfoundland and Labrador Seniors Benefit

The Newfoundland Seniors' Benefit (NSB) was announced in Newfoundland & Labrador’s 1999 budget. It is a supplement to the HST credit.

If the tax filer and/or the tax filer’s partner were 65 or older at any time in the year, and they have applied for GST credit on their federal return, they may receive a payment per year. To receive the credit, the tax filer/or the tax filer’s partner has to apply for the GST/HST credit. Benefits are then combined with the October payment of the federal GST/HST credit. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Non-Family Person

See Persons not in Census Families

Non-Negative Income

Is income that is zero or greater.

Non-Taxable Income/Provincial (refundable) Tax Credits

Non-taxable income refers to the amounts included in a taxfiler's income when applying for refundable tax credits, but not included in the calculation of taxable income; these amounts include workers' compensation payments, net federal supplements received (Guaranteed Income Supplements and/or Spouse's Allowance), and social assistance payments. Beginning with the 1994 data, information is available separately for net federal supplements, workers' compensation and social assistance. Provincial tax credits are a refundable credit paid to individuals by the province in which he or she resided as of December 31 of the taxation year. See also Provincial refundable tax credits.

Northwest Territories Child Benefit

Beginning in July 1998, the Northwest Territories Child Benefit (NWTCB) is a non-taxable amount paid monthly to qualifying families with children under age 18. The Territorial Worker's Supplement, part of the NWTCB program, is an additional benefit paid to qualifying families with working income who have children under age 18. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Northwest Territories Cost of living Tax Credit

Included in 2000, this refundable tax credit is available only to residents of the N.W.T. on December 31 of the taxation year. It is not available to trusts or estates and is based on an adjusted net income. Accordingly, although there is no age limitation on claiming the credit, the recipient must have income to be entitled to basic credit and does not take any account of spousal income; each taxpayer computes it based on his or her income alone, regardless of marital status.

Northwest Territories Supplement of Cost of living Tax Credit

The Cost of living tax credit is supplemented by the additional refundable credit “Supplement of Cost of living Tax credit”, which is not based on income, but is only available N.W.T. residents 18 years of age or over on the last day of the taxation year. The recipient does not have to declare income for the year to obtain the supplement. However, if there was an income, the supplement is reduced by the basic refundable cost of living credit of the taxfiler and its spouse or common-law partner (if any), so the cost of living credit and the supplement cannot double up. Unlike the basic credit, which is claimed by each spouse/partner independently, one of the spouse must claim the supplement for both. Since the supplement is refundable and not income-tested, it does not matter to household income which spouse or partner makes the claim. This supplement was added in 2002.

Nova Scotia Affordable Living Tax Credit

Beginning in 2010, with the Harmonized Sales Tax increase, households with low and modest incomes will receive a quarterly tax credit to offset the restoration of the Harmonized Sales Tax. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nova Scotia Child Tax Benefit

Beginning in October 1998, but retro-active to July 1998, the Nova Scotia Child Benefit (NSCB) is a non-taxable amount paid monthly to help low- and modest-income families with the costs of raising children under the age of 18. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nova Scotia Credit for Volunteer firefighter & Ground Search & Rescue tax credit

Beginning in 2007, this credit is made to residents of Nova Scotia who have been volunteer firefighters for a minimum of six months in the calendar year. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nova Scotia Poverty Reduction Tax Credit

Beginning in 2010, the Poverty Reduction Credit provides tax-free payments to help about 15,000 low-income residents who are in receipt of social assistance. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nova Scotia Taxpayer Refund Program

Is a one-time payment of $155 made in 2003 to residents of Nova Scotia who paid $1 or more in provincial income tax. The refund is part of the government’s commitment to lower taxes in the province. Included in 2003 data only.

Nunavut Child Benefit

Beginning in July 1998, the Nunavut Child Benefit (NUCB) is a non-taxable amount paid monthly to qualifying families with children under age 18. The Territorial Worker's Supplement, part of the NUCB program, is an additional benefit paid to qualifying families with working income who have children under age 18. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nunavut Cost of Living Credit

Included in 2000, after Nunavut was carved out of the Northwest Territories, it inherited this unique refundable cost of living credit for residents of Nunavut who qualify. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Nunavut Volunteer Fire-Fighter Credit

Beginning in 2008, the Volunteer Fire Fighter tax credit is allowed to residents of Nunavut who were volunteer fire fighter for a minimum of six months during the year. Included in Provincial refundable tax credits/Family benefits in the statistical tables for reference years 2008 to 2011.

Old Age Security (OAS) Pension

Is part of the Old Age Security program, a federal government program that guarantees a degree of financial security to Canadian seniors. All persons in Canada aged 65 or older, who are Canadian citizens or legal residents, may qualify for a full OAS pension, depending on their years of residence in Canada after reaching age 18. Old Age Security benefits include all benefits reported for the reference year, excluding Guaranteed Income Supplements and Spouse’s Allowance benefits; see also "Net Federal Supplements" and "Non-Taxable Income/Provincial (refundable) Tax Credits". Starting with the 1994 data, OAS income of non-filing spouses was estimated and included in the tables.

Ontario Child Activity Tax Credit

Introduced in 2010, the Province of Ontario to assist residents with the cost of registering their children (under the age of 19) in eligible activities as defined by the Province.

Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Ontario Child Benefit Program

Effective in July 2007, the Ontario Child Benefit is integrating its Ontario Child Care Supplement program with its basic social assistance benefits for children. It is intended to be completely integrated with the federal child tax benefit program. Benefits are combined with the CCTB into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Ontario Child Care Supplement for Working Families (OCCS)

Included in 1998, the Ontario Child Care Supplement for Working Families (OCCSWF) is a tax-free monthly payment to help with the cost of raising children under the age of seven. Benefits are combined with the Canadian Child Tax Benefit (CCTB) into a single monthly payment. Included in Provincial refundable tax credits/Family benefits in the statistical tables. This credit will be completely integrated into the Ontario Child Benefit in 2014.

Ontario Energy and Property Tax Credit

Introduced in 2010, the Ontario Energy and Property Tax Credit helps low- to moderate-income individuals 18 years of age and older, and families, with the sales tax they pay on energy and with property taxes. Included in provincial refundable tax credits/Family Benefits in the statistical tables. It became part of the Ontario Trillium Benefit in 2012.

Ontario Guaranteed Annual Income System (GAINS)

Included in 2012, the Ontario Guaranteed Annual Income System (GAINS) ensures a guaranteed minimum income for Ontario seniors by providing monthly payments to qualifying pensioners. The monthly GAINS payments are on top of the federal Old Age Security (OAS) pension and the Guaranteed Income Supplement (GIS) payments received.

Ontario – Healthy Homes Renovation Tax Credit

Effective in 2012, the Healthy Homes Renovation Tax Credit is a permanent, refundable personal income tax credit for seniors, and family members who live with them, to help with the costs of improving safety and accessibility in their home.

Ontario Home Electricity Relief

Was a one-time payment of $120 made in 2006 to lower-income residents of Ontario to assist them with the rising cost of electricity. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Ontario Homeowner’s property Tax and Sales Tax credit

Starting in 1986 and ending in 2009, the Ontario Homeowner’s property Tax and Sales Tax credit helps low- to moderate-income Ontarians who were 16 years of age and older (if the individual was under 19 and lived with someone who received Canada Child Tax Benefit payments for them, they were not eligible) with property taxes and the sales tax they pay. Included in provincial refundable tax credits/Family Benefits in the statistical tables. After 2009 it was separated and replaced by the Ontario Energy and Property Tax Credit and the Ontario Sales Tax Credit.

Ontario - Northern Ontario Energy Credit

Beginning in 2010, the Province of Ontario introduced the Northern Ontario Energy Credit for residents of these Northern Ontario districts: Algoma, Cochrane, Kenora, Manitoulin, Nipissing, Parry Sound, Rainy River, Sudbury, Thunder Bay or Timiskaming who pay rent or property tax on their principle residents and who apply for the credit.

Included in Provincial refundable tax credits/Family benefits in the statistical tables and as of 2012 is part of the Ontario Trillium Benefit.

Ontario Sales Tax Credit

Introduced in 2010, the Ontario Sales Tax Credit helps low- to moderate-income individuals, 19 years of age and older, and families, with the sales tax they pay. Included in provincial refundable tax credits/Family Benefits in the statistical tables. As of 2012 it is part of the Ontario Trillium Benefit.

Ontario Senior Homeowners Property Tax Grant

Beginning in 2008, this grant is an annual amount provided to help offset property taxes for seniors with low and moderate incomes who own their own homes. Included in Provincial refundable tax credits/Family benefits in the statistical tables.

Ontario Sales Tax Transition Credit

Introduced in 2010, this benefit provides three payments to families and single people to help with the transition to the HST. Families (including single parents) can receive up to $1,000 in total. If the person is single, he or she can get up to $300 in total. The first benefit payment and the second benefit payment were paid in June and December 2010. The final benefit payment was paid in June 2011. Included in provincial refundable tax credits/Family Benefits in the statistical tables.

Ontario Trillium Benefit

Effective 2012, the Ontario Trillium Benefit helps people pay for energy costs, and provides relief for sales and property tax. It includes the following:

- Ontario Sales Tax Credit

- Ontario Energy and Property Tax Credit

- Northern Ontario Tax Credit

Other Government Transfers

Added in 2010. Currently only includes the Working Income Tax Benefit (WITB).

Other Income

Includes net rental income, alimony, income from a limited partnership, retiring allowances, scholarships, amounts received through a supplementary unemployment benefit plan (guaranteed annual income plan), payments from income‑averaging annuity contracts, as well as all other taxable income not included elsewhere. Beginning with the 1992 data, this variable also includes the imputed income of imputed spouses, as derived from the tax return of the filing spouse. Beginning with the 2008 data, this variable also includes the registered disability savings plan income. See also "Total income".

Parent

Is a person for whom we have identified one or more children living at the same address. See also "Census families" and “Children”.

Participation Rate

Is the count of a given population of an area with labour income expressed as a percentage of the total for that same population in that same area.

Persons not in Census Families Previously Non-Family Persons

Is an individual who is not part of a census family – couple family or a lone-parent family. These persons may live with their married children or with their children who have children of their own (e.g., grandparent). They may be living with a family to whom they are related (e.g., sibling, cousin) or unrelated (e.g., lodger, roommate). They may also be living alone or with other persons not in census families. See also "Census families".

Prince Edward Island volunteer firefighter tax credit

Beginning in 2012, this credit is available for residents of Prince Edward Island who have been volunteer firefighter in the calendar year.

Private (other) Pensions

Include pension benefits (superannuation and private pensions) other than Old Age Security pension benefits and Canada/Quebec Pension Plan benefits.

Provincial Refundable Tax Credits/Family Benefits

Unlike non-refundable tax credits, these amounts are paid to the taxfiler, regardless of tax liability. Included below are the refundable provincial tax credits received by taxfilers:

Alberta: